The Secretariat of Evaluation, Planning, Energy and Lottery (Secap) of the Special Secretariat of Finance of the Ministry of Economy has requested views on the fixed odds sports betting regulatory model that should be introduced in Brazil. Seven questions have been provided exploring issues such as integrity, corporate social responsibility and fraud prevention. That commercial enterprise is currently conducted through around 50 retail and online/remote sports betting brands, including many globally recognised household names, across six continents.

The International Betting Integrity Association (IBIA) is a not-for-profit trade body representing the betting integrity interests of many of the largest licensed retail and online betting operators in the world. The association has longstanding information sharing partnerships with leading sports bodies and gambling regulators around the world to utilise that data to investigate and prosecute corruption.

IBIA, which was established in 2005 and formerly known as ESSA, is the leading global voice on integrity for the licensed betting industry. It represents the sector at high-level policy discussion forums and maintains a policy of transparency and open debate, publishing quarterly integrity reports analysing activity reported on the IBIA monitoring and alert platform.

IBIA has provided examples of the best practice regulatory models in operation based on its significant experience in this area. The association has sought to bundle together related crosscutting questions into a single answer. “The association would welcome further engagement with the Brazilian authorities concerning the development of a regulated sports betting model and on the implementation of effective integrity measures in particular”, said Khalid Ali, Secretary General, International Betting Integrity Association.

Listed here are the most important tips IBIA made to the Brazilian Ministry of Economy:

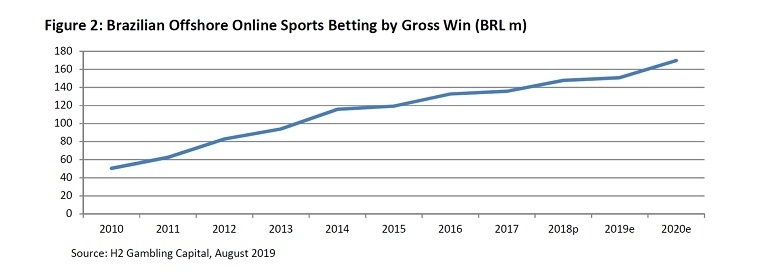

That consumer activity is reflected in the Brazilian market and where the lack of licensing will mean that sports betting gross win for offshore operators will reach BRL 169.8m by 2020.

However, within a proper regulatory and taxation structure Brazil could see a licensed market equating to upwards of BRL 2,389.2m in gross win by 2024, with sports betting equating to 95% of that market.4 The following paragraphs seek to outline the key elements IBIA believes will set the foundation for a robust and successful sports betting regulatory and fiscal regime in Brazil.

As such, we recommend that all aspects of the market benefit from a licensing system that attracts and allows any number of operators that fulfil the licensing criteria to offer betting. Indeed, the prevailing policy direction in other jurisdictions endorses this licensing method: the UK, Denmark, Sweden, Malta, Spain and many others attest to the success of this approach.

It is also important that, as with the countries listed above, any licence fees are proportionate and wholly based on the necessary administrative costs of proper market regulation. Licensing fees should not be used as a means to impose an unjustified revenue raising tool, and in effect an additional means of taxation, which would deter operators from seeking a licence.

With that in mind, the association strongly supports and encourages the Brazilian authorities to adopt a licensing system which is open and allows any company to apply for an online licence. Aligned with that is the adoption of a taxation model that reflects the international availability and dimension of sports betting products and is not over-burdensome from that perspective.

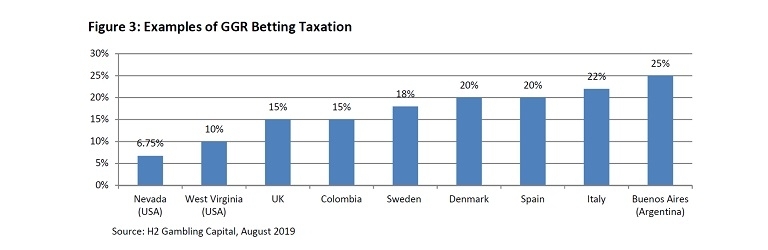

The evidence from European markets shows that a burdensome fiscal framework, notably for online betting and relative to other markets, is counterproductive to market maximisation. The gross gambling revenue (GGR) model has become the standard approach to taxation for online gambling services across much of Europe and indeed globally (see Figure 3).

A turnover tax (on stakes) invariably creates betting products that are less competitive and are unappealing to consumers compared to operators offering the same products taxed on GGR. As with other services, betting consumers are product and price sensitive and will therefore switch between operators, including offshore, depending on the competitiveness of the betting offer.

The type and level of taxation thus significantly influences the size and product availability of the licensed betting market and is an important driver of market growth, structure and consumer attraction. The association and its members are therefore concerned about the proposed turnover taxation approach proposed in Brazil, which goes against global norms.

In particular, the negative impact this will have on consumer challenging to Brazilian licensed operators and the importance of achieving a high channelling rate as a core component of any successful regulatory system. An assessment of European countries shows that their approach to taxation directly impacts the rate of consumer activity channelled to their regulated market.

For example, those in the 10-20% GGR range have ‘high to very high’ levels of channelling of consumers to their regulated operators (as opposed to offshore operators), with the UK (15% GGR) and Denmark (20% GGR) estimated to have consumer channelling rates of 95% and 90%.

Whereas channelling rates for those employing a turnover tax is ‘low to medium’; Poland (12% turnover tax) is estimated to only have 30% of its consumer activity channelled to its operators and France (9.3% turnover tax) around 60% channelled to its licensed betting operators.

Turnover based markets are unattractive to betting operators (especially online) and consumers alike and invariably suffer from low levels of licence applications and related market competition. To highlight this, in 2016 online gambling licences in the UK numbered over 200, with Spain 51 and Denmark 38 (all have a GGR taxation of 15-20%), whilst France had only 16 licensed operators, with Poland 4 and Portugal 2 (all employing a turnover taxation of 8-16%).

South and Central American markets have also adopted GGR taxation approach, notably: Colombia 15%, Buenos Aires (Argentina) 25% and Mexico 30%. Whilst many of the state-level markets opening in the United States of America are similarly also adopting a GGR approach (e.g. Nevada 6.75%, Indiana 9.5%, West Virginia 10%, Mississippi 8-12%, New Jersey 8.5-14.25%).

IBIA does not believe that the burdensome turnover taxation approach proposed in Brazil will prove as successful in attracting operators or to channelling consumers to that market as a GGR model. There is a clear danger that many Brazilian consumers will be attracted to sports betting products in other more fiscally advantageous markets, negating Brazilian regulatory measures.

The approach will serve to create a far more challenging regulatory and integrity environment than would be evident under a more globally representative and fiscally competitive framework. IBIA members wish to engage in an effective Brazilian regulatory and fiscal betting environment and we contend that further consideration should therefore be given to the tax model and rate.

The available data strongly suggests that to maximise the revenue generating potential of the Brazilian market, and to establish an effective licensing and regulatory regime with high levels of consumer channelling, the introduction of a GGR taxation of 15-20% is necessary.

In summary, a successful betting regulatory framework begins with an interrelated system of

licensing and taxation, and which form key drivers to the success of the market. There is clear

evidence that an open (unlimited) licensed market and GGR taxation approach represent the

two key intertwined elements of successful regulatory and fiscal models in other markets

Restricting product availability will prove counterproductive to maximising the market’s fiscal potential and also regulatory and integrity oversight. Product limitations are invariably arbitrary and benefit offshore operators unhindered by those constraints. Such restrictions are often attempted to be justified for two main reasons: a) social concerns about potential addiction; and b) that certain bets may facilitate the manipulation of sports matches and related betting fraud.

The Brazilian authorities will understandably, and quite rightly, want to ensure that its licensed sports betting market is well-regulated and provides suitable mitigating measures against social harms. IBIA and its members support an approach to regulation that balances commercial, social and regulatory aspects, but that such action is evidence-based and proportionate.

It is important to emphasise that many countries around the world have betting markets without significant consumer and trade restrictions around regulated sports betting and its availability and do not suffer from increased levels of addiction as a result. Responsible betting operators work closely with regulators to set clear parameters, including self-exclusion policies tailored to each customer, whilst allowing consumers access to a wide variety of regulated products.

As such, restrictions on the type of bets regulated betting operators can offer to consumers “are not warranted at this time. Taking such action may also increase the risk that bettors would be driven to seek to place bets via grey and black markets, over which we have no oversight.”

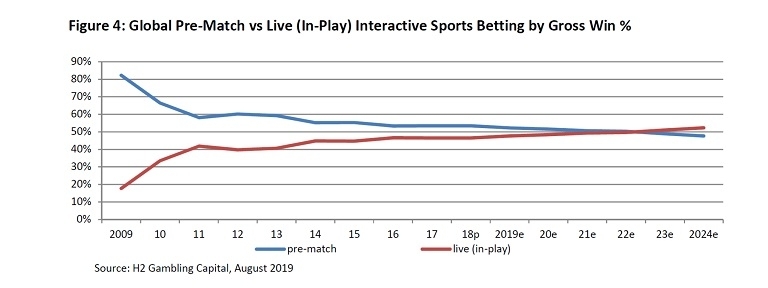

Removing the attractiveness of the offshore market and increasing regulatory oversight must be a key objective for any licensing model. As data from leading market analyst H2 Gambling Capital shows, live betting represents an increasingly large proportion of all sports bets placed globally and is therefore a key component of operators’ product catalogue. Any product prohibition, notably for live betting, will thus prove counterproductive to achieving that aim.

The Council of Europe (CoE) Convention on the Manipulation of Sports Competitions is recognised as the principal international approach. It seeks to co-ordinate the fight against match-fixing at national level (through national integrity platforms) and to foster co-operation between all organisations and relevant authorities at national and international levels.

The association helped to develop the Convention and supports many of the measures included within it. Signature and ratification of the Convention is open to states outside of the Council of Europe and IBIA suggests that Brazil consider the benefits of adopting the integrity practices contained within it and engaging in the related international integrity cooperation platforms.

A range of integrity measures are readily available and employed by various regulatory authorities, including: obligation for operators to report suspicious betting; information sharing; voiding suspicious bets; suspension of betting markets. However, the model in operation in the UK is widely seen as one of the most effective and is an example of best practice in this area.

This strategic cross-sector approach forms part of the UK’s wider Anti-Corruption Plan43 and is a blueprint of good practice and effective detection and enforcement measures to protect sports, consumers and regulated operators from the negative impact of betting related match-fixing. The association recommends that the Brazilian authorities adopt a similar integrity policy.

IBIA supports robust sanctions for those found guilty of betting related corruption. However, it is only through cooperation and partnership working, both nationally and internationally, that evidence-led investigations and sanctions can have the desired impact. The association would therefore welcome establishing a betting integrity cooperation agreement with the Brazilian authorities to exchange information to protect betting markets and related sporting events.

Source: Games Magazine Brasil