Pay4Fun App’s goal is to welcome new customers, lead them to finish the registration and operate their digital wallet efficiently, without bureaucracy. For achieving this purpose, all details are fundamental.

According to the Market Analysis survey on Digital Banks conducted by Idwall, user satisfaction during the onboarding process significantly impacts their interest in remaining a financial institution customer.

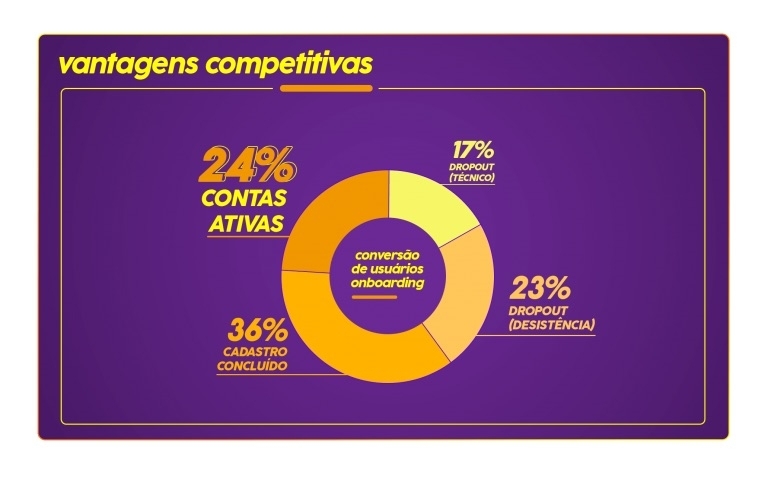

The report states that good onboarding has excellent potential to be a competitive advantage for institutions and reduce customer acquisition costs.

Data shows that 4 out of 10 users do not complete their registrations in digital solutions platforms. About 17% of people that do not finish onboarding have some technical difficulty during the process.

For that reason, Pay4Fun makes the arrival process on its platform increasingly optimized to its customers: a large portion of the Brazilian population that is unbanked or not fully served by traditional financial institutions services.

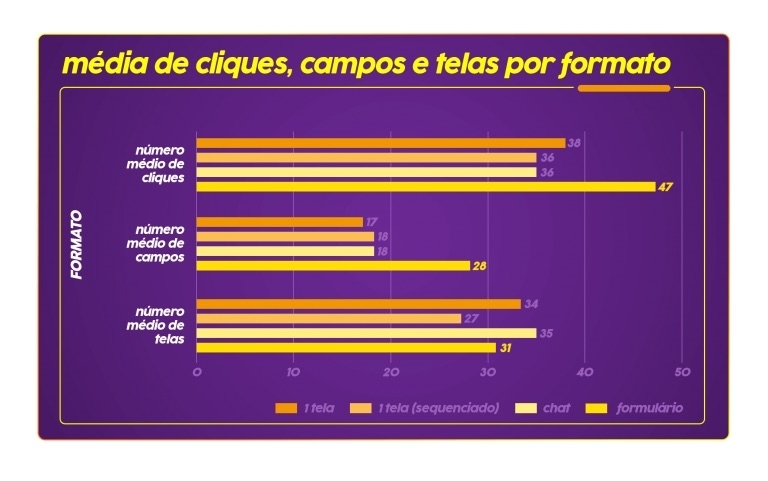

Regarding the customer registration format for digital financial solutions, the Idwall report finds that the average of clicks, fields, and screens in different forms can directly impact customer retention on a digital platform.

In the chart below, it is clear that institutions using registration forms have a higher average number of clicks and also more fields than companies that use other related formats:

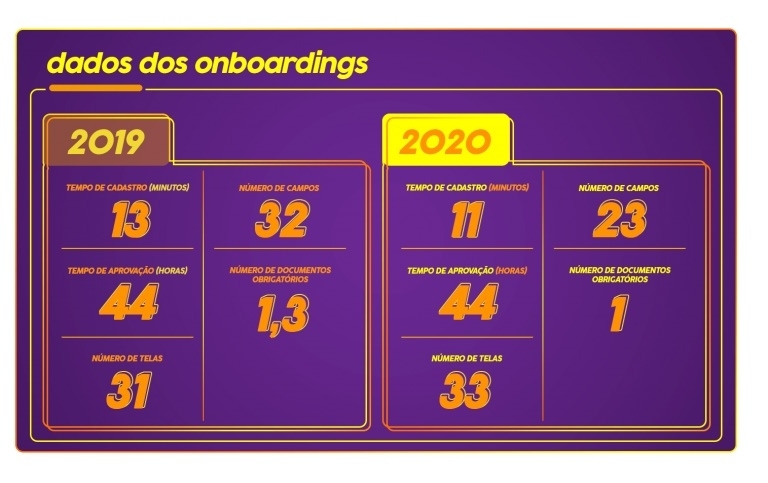

Regarding the onboarding averages of financial institutions such as digital banks and wallets, the Idwall report shows the following scenario:

Calculating the average clicks, fields, and screens in 2019 and 2020, we have the panorama below:

The Pay4Fun App has a fast and simplified onboarding process, and is an ideal solution for the customer and a very efficient option for its integrated partners.

Pay4Fun is an efficient solution for the promising Brazilian market

In recent years, the digital financial solutions market in Brazil has grown significantly. According to FEBRABAN, the Brazilian Federation of Banks, in 2019, Brazilians accessed 93.6 million accounts through mobile devices. This data reflects the increasing digitization of the population.

According to the PNAD (IBGE), in 2018, 79% of people had Internet access, and 93% had a cell phone.

Currently, mobile banking represents 44% of all banking transactions in the country. Brazil is also moving towards a mobile-centered omnichannel system.

All that data demonstrates the increased competition in the market and the consequent level of consumer demand for the online banking experience’s resources and procedures.

Brazil has one of the world’s most advanced financial and banking systems. Recently, the Central Bank launched a technology solution named PIX.

PIX allows financial transactions to be carried out in up to ten seconds, 24 hours a day, including weekends and holidays.

Pay4Fun is the result of that promising scenario in Brazil. The company offers one of the best financial platforms dedicated to a diverse profile of customers and partners.

With more than 100 integrated partners, Pay4Fun also has other products available such as Pay4Fun Card, Mastercard banner, with no annual fee.

Source: Pay4Fun Blog