When it comes to data management, the sports betting industry may just want to take a look at the playbook of the financial services industry. The 2008 Great Recession was not only a financial and liquidity challenge for financial institutions, it was also a data management challenge. Following the crisis, new regulatory requirements were a catalyst for data standards and data automation supporting transactional reporting, risk management, surveillance, regulatory reporting and other data-intensive business processes.

Nasdaq has been at the forefront of the data revolution leveraging a combination of industry data standards and world-class technology in big data and cloud computing.

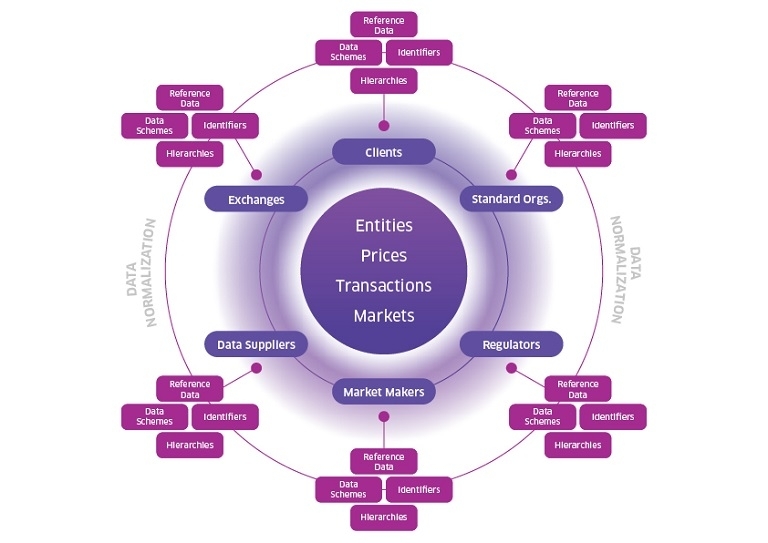

Financial markets data landscape

A familiar theme

The data challenges of the sports and gaming industry are not unlike financial markets. Both have a need to uniquely identify markets; reconcile identifiers and vocabularies across data suppliers, market makers and operators; and support multiple schemas from data contributors while operating in real-time environments.

Financial institutions, including banks, brokers and exchanges, are dependent on multiple data subscriptions to support their business activities. Data aggregation is paramount – one supplier might provide real-time prices, whereas others might provide closing end of day prices. Each supplier will present data in their own vocabularies and data schemas. If that is not challenging enough, regulators will require transaction reporting in their own standards.

Over the years, the financial industry has established identifier standards to help uniquely identify securities and legal entities. These can include ISO identifiers such as ISIN and CUSIP. Some data suppliers’ identifiers have become so commonly used that they have become standards in their own right – Bloomberg and Six Telekurs are examples.

But not all identifiers are alike. For example, there are identifiers at the exchange level, the market level, the country level, etc. These various identifiers need to be cross-referenced and their hierarchical relationships supported.

As an exchange both in the US and Nordic markets, Nasdaq has not only developed data solutions for our financial clients to address these challenges, but is also an agent for ISO organisations in creating identification standards in the markets we serve.

Nasdaq is now bringing that same focus and expertise to the data challenges of the sports betting industry.

Our service is providing solutions for some of the most common business challenges related to data, and offering answers to questions including:

These challenges all share a common denominator, which is normalising your supplier data to a common vocabulary or taxonomy and being able to uniquely identify events and markets. While the concept is simple, Nasdaq understands the challenge. Establishing a common vocabulary means not only establishing common reference names but also normalising individual reference values across data providers (i.e. team names, player names, betting types, etc.).

Nasdaq can also provide you with tools to better manage and understand your data. Our services are supported by an integrated suite of data governance tools that support data registration, metadata management and data lineage.

We understand that the ability to reconcile and normalise across a complex data landscape is paramount to growing your business and managing risk. Let us bring our expertise and technology solutions to solve your complex data challenges. There doesn’t need to be a crisis to revolutionise your data management practices.

Andy Phillips and Joseph Turso

Nasdaq

Source: EGR

Andy Phillips (left) is head of business development for sports and gaming within the Market Technology business at Nasdaq. He has 12 years’ experience working in sports betting data and technology across BD, strategy, product and sales roles including nine years at Betgenius/Genius Sports. Phillips graduated from the University of Bristol with a degree in Chemistry. He resides in London.

Joseph Turso (right) is a vice president of Nasdaq, co-leading data governance. He has over 25 years of experience in data management supporting and building data solutions. Prior to joining Nasdaq, he was the product manager for SmartStream Technologies, which was an industry initiative to build a reference data utility for financial institutions. He was an executive director at Morgan Stanley for 18 years with various roles in Enterprise Data Management. He was also a director in the Enterprise Data group at Bank of America and was a director in the Data Management Group at Citadel LLC.