It its recent 2019 annual report, Kambi analyzes the current position of the company in Latin America and gives special atention to the business possibilities that it sees in Brazil.

Kambi’s regulatory expertise and quality of product has put the business in a prime position in Latin America, where it is poised to take advantage as and when additional territories enact regulatory frameworks. The company’s success in Colombia has significantly raised its profile in the region, giving it a springboard into other markets.

This experience in Colombia, combined with the partnership in Mexico with Grupo Televisa, where Kambi provides sports betting services to 18 PlayCity casinos, stands Kambi in good stead to capitalise on emerging opportunities in other Latin American countries.

“Looking to the future, Brazil is a market with considerable potential, and signs are encouraging that a licensing regime allowing for fixed-odds sports betting is forthcoming. At the end of 2018, the country enacted a law legalising fixed-odds sports betting in the land-based and online environments. Although the core details of a regulatory framework are still to be established, concrete steps have been taken, with Brazil’s Ministry of the Economy opening consultations and publishing draft plans on the outlook for licensing,” says the company’s report.

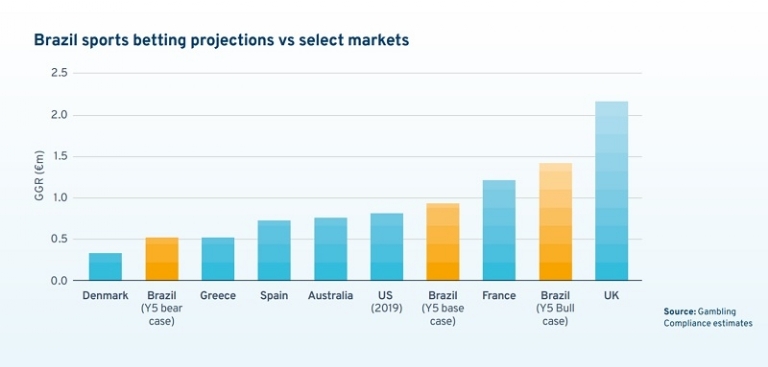

“As the most populous nation in Latin America, home to more than 200 million people, the scale of the sports betting opportunity is undoubtedly vast. According to industry journal Gambling Compliance, a regulated Brazilian market could become the second largest in the world within the first five years, behind only the UK, although the US is expected to take the number one position over time,” the report concludes.

2019 in numbers

The 98-pages report shows some really interesting numbers for the company explaining its success in the international gaming market:

- Renevue up% 21% to 92.3m

- Operator turnover: up 37%

- Active players: up 52%

- Bets placed: up 40%

- 20+ operators across 6 continents

- Monthly transactions: 500 million (approximately)

- Active in US 7 markets

- Market firsts in 5 US states

- Launched in 18 US properties

- 6 new partners signed (BetWarrior, Jack Entertainment, Mohegan Sun, mybet, Penn National Gaming, Seneca Resorts & Casinos)

- 865 employees across 7 locations

COVID-19 update

Along with an update of the firt quarter of the year, Kambi introduced different measures taken in light of COVID-19 impact.

The company said that “despite the impact of COVID-19 on sporting calendar in the last two weeks of Q1, revenue of the period was strong and is expected to be in range of 27.5 to 28 million Euro.”

Kambi also stated that “cost saving programme will result in cuts across whole business, including significantly reduced travel and marketing costs, a freeze on staff recruitment and a substantial reduction in data costs associated with fewer Sporting events.”

Finally, the company also informed that cost saving package “will also result in associated savings in capitalised developments costs of 20-30% compared to fourt quarter of past period.”

Source: GMB