Sports betting has become a consolidated activity that grows 11.5% each year. In 2020, the global market was valued at US$59.6 billion - it could reach as much as US$127.3 billion in 2027. In Brazil, the numbers are also encouraging. With the regulation of sports betting, the country could become one of the main markets in the world, taking into account the size of the population and the passion of the Brazilian people for sports.

Games Magazine Brasil offers all the results of the research “Brazilian Gambler: the sports betting market in Brazil” survey, which took place in June this year with data from Industry Insights - Telecom, Platforms and Education Services – and that Globo recently published.

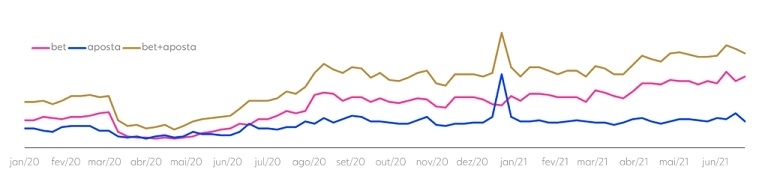

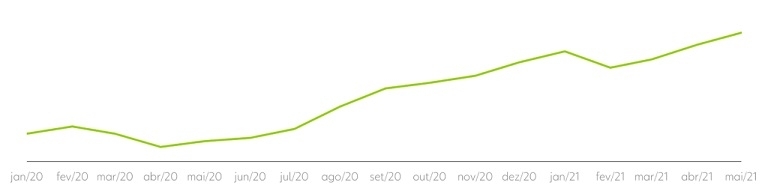

The bets are increasingly attracting the attention of Brazilians and the sector's turnover went from R$2 billion (US$360m) in 2018 to R$7 billion (US$1.25bn) in 2020. At the same time, the increase in the search for related words and terms follows the growth curve of the advertising investment of brands in the betting market, by all means.

ADVERTISING INVESTMENT

Sports Betting Market - All Media

The sector is increasingly competitive and the growth in advertising investment proves this movement. With market consolidation, it is important that interested brands take advantage of this high visibility.

In addition to sports betting, Brazilians also invest in:

69% - Federal Lottery

38% - Fantasy Game

36% - Casino online

33% - Informal bet on various subjects (worth money but not on a website)

32% - Bingo online

In the fantasy games area, as expected, Globo's CartolaFC, which explores the games in Brasileirão football championship, is in first place, with 78% of respondents by Industry Insights indicating that they play fantasy, while 57% do so in the ESPN Fantasy.

Among the 36% who play online casino, the modalities that bet frequently are:

78% - Rolette

66% - Blackjack

64% - Table games

63% - Slots

61% - Video Poker

50% - Live games with dealers

For Brazilians, betting online is:

67% - Entertainment

43% - Business

38% - Sport

Also mentioned: 23% games of chance | 12% something illegal

Main motivators for sports betting are FUN, INCOME and CONNECTION.

-For 60%, betting is a form of fun

-52% use it to increase income

-1/3 bet to connect or socialize with friends

-12% of respondents stated that sports betting is their MAIN SOURCE OF INCOME

Player profile measured by betting frequency

18% - SUPER HEAVY USER / 7 times a week

16% - HEAVY USER / 4 to 6 times a week

48% - MEDIUM USER / 1 to 3 times a week

18% - LIGHT USER / 2 to 3 times a week or less

Kind of gambler

55% MODERATE - I preserve the security of my bets, but I like to take chances sometimes

33% CONSERVATIVE - I avoid taking risks

12% AGGRESSIVE - I usually take risks in search of higher returns

Engaged bettors

38% made sports bets in the last 7 days

30% declared to have placed a bet yesterday

Only 9.8% of bettors placed their last bet within a period between 3 and 6 months.

The main reasons are:

51% - I'm saving in the economic scenario

27% - I'm tired of losing

20% - I only bet on special games

18% - I lost money and stopped playing

MONTHLY INVESTMENT

18% - Up to R$ 30

17% - R$ 31 to R$ 50 range

9% - R$ 51 to R$ 70 range

18% - R$ 71 to R$ 100 range

17% - R$ 101 to R$ 200 range

9% - R$ 201 to R$ 500 range

10% - More than R$ 501

*Only 2% do not use real money and only wager with bonus or play Money

PANDEMIC

Among survey respondents, more than half claim to have started in the sports betting world during the pandemic

59% started betting a maximum of 12 months ago

13% started between 12 and 18 months

28% are gamblers for over 18 months

Even in the face of the pandemic scenario, people continued to bet. With more time available to dedicate, 27% of respondents increased the amount of bets. For 18% of them, the pandemic has not affected their way of betting. Among the most cautious, 22% opted for bets with less risk and 21% decreased investment in betting.

THE GAMBLER'S FEELING

when PLACING A BET

51% - Excited

48% - Confident

44% - Anxious

when WINNING

61% - Happy

52% - Excited

43% - Lucky

21% - I take this opportunity to play more

when LOSING

45% - Frustrated

37% - Sad

31% - Unlucky

27% - Angry

22% - Play again to recover what I lost

20% - I don't play for a while

20% - Unmotivated

Diversifying investment

How many gambling sites do you have a membership? The Brazilians replied:

26% - 1 site

33% - 2 sites

29% - 3 to 5 sites

12% - 6+ sites

CHOOSING THE FAVORITE BETTING SITE and the main factors by degree of importance

1st - Speed in payments;

2nd - Incentive bonus (free bets);

3rd - Wide range of ways to transfer values, deposits and withdrawals;

4th - Best odds (quotes) of games;

5th - Largest number of sports, games and markets within each game.

THE IMPORTANCE OF POSITIVE EXPERIENCE IN WINNING NEW BETTORS

For 54.2%, the positive experience of friends is the item that gives the most security and confidence when opening an account on a sports betting site. 78% trust sites that friends use or refer to for bets.

Other factors are:

54% - Sites with secure connection certificate

49% - Positive reviews from specialized sites

41% - Partnerships with companies I know and trust (eg payment systems)

41% - Have a license from a regulatory authority

36% - Sponsor a known team, player or sport

28% - When I see some type of brand advertising on television

27% - When I see brand advertising on sports sites

21% - When I see brand advertising independent of the media

MOST BETTED SPORTS

(Each respondent selected an average of 4 sports)

81% - Football

33% - Basket

29% - eSports

26% - Poker

23% - MMA

24% - Voley

21% - Horse Racing

21% - Box

21% - American Football

10% - Tennis

How do you find out about sports content to place bets?

56% - Sports TV shows

56% - Sites specialized in sports News

40% - Groups on social network

36% - Industry Specialists

32% - Consulting data and reports

32% - Influenced by friends and Family

30% - Through influencers

Channels used to monitor, in real time, the broadcasts of the events you bet on

(it can be simultaneously or not)

63% - By betting sites

52% - Social networks

52% - Pay TV channels

48% - YouTube Channels

46% - Open TV channels

*Still on the importance of communication for bettors, SporTV appears first in the list of favorite sports channels.

CHOOSING THE MODALITY

60% - bet on sports they like to watch

47% - modalities that they know in depth

47% - based on quotes and chances of winning

37% - modalities with a large offer of statistical analysis

*The ODD quotation is among the 3 main factors that influence the choice of sport to bet

*Team performance influences the willingness and/or frequency of betting for 67% of respondentes

PUNTER vs TRADER

Kind of bettor:

20% - Punter

19% - Trader

38% - Both

24% - Don’t know

Improve the experience

*Working with players who don't know which modality to invest in can be an opportunity. The survey found that 44% of respondents would like a tutorial for beginners on how to place sports betting.

The most popular bet types are:

55% - Simple bets

(You bet on a result, and if your prediction is correct, you win)

42% - Multiple bet

(Betting on two or more outcomes, eg two separate basketball games. Multiple bet pays only if the outcome of all your choices is correct)

36% - Double chance

(You choose two of the three possible outcomes (win, lose and draw) - which increases your chances of winning, but reduces your profit if you hit)

THE POWER OF ADVERTISING

Main platforms with advertising circulation remembered

64% - Internet

54% - Social Network

48% - Pay TV

47% - Open TV

16% - Newspaper

16% - Foreign media

16% - Magazine

13% - Radio

*85% agree or totally agree that better known sites are more trustworthy and 72% like to see the brand actively engaged in advertising

Agree or totally agree:

71% - When I see advertising for a betting site that I don't know, I'm interested in knowing more

67% - Being impacted by the advertising of a betting site can motivate me to bet or visit the site

61% - I feel motivated to bet when I'm impacted by some advertising

57% - Television advertising has a strong influence on me

51% - I started betting after being impacted by advertising

INCREASING THE BET

What would drive you to increase the amount of online sports betting?

57% - Special bonus/cashback payments

44% - Access to more detailed analysis

44% - Easier payment

44% - Easier site to navigate and bet

*Only 9.8% said it would hardly increase the amount of bets

How to improve your experience?

53% - Pay winners faster

44% - Have more live game streams

43% - Provide updated statistics on all game modes

35% - Perform technical analysis and comments after matches

Authored by: Inteligência de Mercado Globo | Rafael Garey and Glauber Prado

Layout: Izabella Donafe, Roger Arruda and Daniel Frias

Edition: Tiago Lontra and Luiza Lourenço

Source: Gente - O mercado de apostas esportivas