GMB - I would like you to introduce Oddin to the Brazilian public. What solutions does the company offer to bookmakers and casinos?

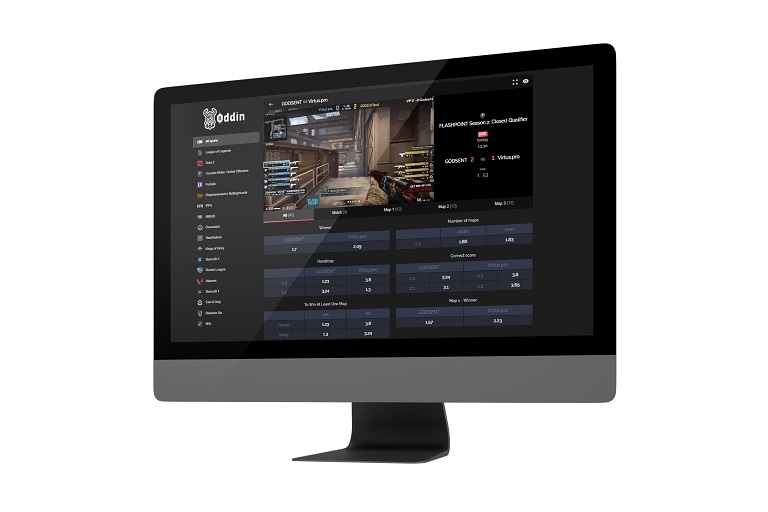

Marek Suchar - Oddin is a dedicated eSports odds feed, risk management, and iFrame solution provider. Our entire solution is focused on delivering the most engaging eSports betting experience. This means live betting on the most followed eSports like Counter Strike: Global Offensive, with multiple betting opportunities available almost all the time. This way we give the users the freedom to bet on what they want, when they want. The current market standard is to bet on very few betting options and only during roughly half of the game.

How do you see the growth of eSports worldwide, mainly during pandemic?

ESports as an industry has been experiencing intense growth over the last years, but during the pandemic, it just skyrocketed. ESports was not limited by physical presence, so the competition continued online. Because of the sports suspension, many people that were not familiar with eSports started watching electronic games and betting on them. Sporting simulators, including FIFA and NBA2K, attracted a lot of eyeballs, but once the sports came back, they seemed to lose their momentum. On the contrary, core eSports like CS:GO or League of Legends have kept the growth and we expect it to keep growing at a high ratio in 2021.

However, it was not all that rosy for eSports in 2020 as the majority of offline events were canceled, so some of the important revenue streams for tournament organizers (including tickets & merch sales on the site, etc.) were completely gone. Also, due to technical limitations (ping), the teams were able to play within the same region, but not on an international level.

With the increase in eSports leagues and championships around the world, a new market, betting, opens up for the segment. How do you evaluate that moment and the business itself?

Betting in a sense is putting money where your mouth is. So, it is an additional layer of engagement, to have more thrill when you are watching the live game. Studies are showing that betting increases engagement as you want to make a more educated decision when placing a bet. Because of that, people that bet tend to follow teams more closely and gather more information about their opponents and the game itself. So, we will see growing engagement from eSports fans.

Yet, we believe that the betting industry has still not adapted to the new paradigm of eSports. Many sportsbooks indeed added eSports to their offering, but their approach is not the right one. ESports bettors are way younger and need a different approach. We have found that most of the providers are closing their live betting opportunities during most of the game and offering very few options to bet on. The younger generations are very demanding, and they do not tolerate a betting experience where they have very few betting options and they can’t bet when they want to.

What are the modalities that have grown the most and what future do you see for them?

We have found that eSports fans prefer a live-betting experience that represents more than 80% of the entire volume. In terms of eSports titles, we believe that this year the leaders will continue being Counter-Strike, League of Legends, and Dota 2 globally with the first being dominant specifically in Brazil. But it would not be surprising if other titles such as Valorant continue growing and challenge the top 3.

Brazil, similarly to South-east Asia is specific in focus on mobile eSports. Titles like Free fire enjoy huge popularity among young audiences in Brazil. It is just a matter of time when live betting will be available on this title. We have the aspiration to be the first one globally to do so in the upcoming months.

Brazil is a giant in eSports and the number of athletes and teams is growing. What do you think of the Brazilian market and what opportunities do you see for the sector?

We believe Brazil is one of the most interesting eSports regions with probably the most passionate audience. The fanbase is massive, the scene is growing fast, and even big companies are investing in it. It is not a casualty to see even football stars like Casemiro creating their eSports teams. We expect the scene to become more professional, to attract more audience and more sponsors that will help to strengthen the grassroots. With the demographics and economic growth, Brazil is well-positioned to cement its position as the key eSports player globally.

From our perspective, if we look at the betting scene, there is a lot to improve: bookmakers operating in the country are not yet offering a competitive eSports betting experience.

Brazil has two of the most popular teams in CS:GO: Furia and MIBR. Players like coldzera, fer, or FalleN are among the most successful players over the last years in the competitive scene. How can bookmakers adapt their offerings to the new Brazilian generations who love eSports and want to place bets on their favorite games such as CS:GO?

CS:GO is a game that can’t be compared to football or basketball. Providers need to understand how the game works to offer an engaging betting experience. This is not easy as it requires a combination of the right technology, eSports dedicated team of traders and access to official data.

The new Brazilian generations who love eSports want to have the opportunity to watch their Furia and MIBR games directly on the sportsbook. They want to have the chance to express their opinion when they want and place multiple bets while they’re engaging with the game. If you don’t give them this experience, they will just follow their favorite teams on Twitch and won’t engage with live betting.

In Twitter’s rankings of most-commented topics of 2020, it was identified that Brazil is the fourth country in which the most talked about games, and among the ten most tweeted teams on the planet, three are Brazilian. Those millennials could be attracted to betting sites and online casinos?

Of course! But you cannot attract a millennial if you don’t understand their needs. They are used to Netflix, where they can pick something to watch over thousands of options. They like to open Spotify and have the freedom of listening to whatever they want. If sportsbooks want to attract millennials, they have to offer an eSports betting product that is comparable to other content on demand that millennials are used to. You should cover all their favorite games with live-streaming, have the ability to bet all the time and give the users many different betting options. We are speaking about the huge fanbase, so the potential is immense. It is just time for sportsbooks to realize they need to invest in eSports and adapt their offering to what the fans demand.

With all this strength, Brazil still does not have sports betting regulated. Do you believe in a soonf regulation of the activity in the country? What is your forecast for the growth of the eSports betting business?

Our partners in the region are very optimistic about it. Betting regulation is a long process and can take time, but we hope that this year a lot of progress will be made in the area.

The eSports industry is already huge in Brazil and will keep growing a lot in 2021. The eSports betting business will follow this huge growth as soon as operators understand Brazilian users’ needs. They need to offer a competitive product to attract younger generations to their sportsbooks and take advantage of the following that games like CS:GO have in Brazil.

How do you can help operators to provide them the best odds to achieve a competent odds feed that can bring engagement to punters?

Our team is very experienced in eSports betting, having worked as eSports market makers for Betfair Exchange in the past. We offer bookmakers the best eSports product together supported by risk management tools. The product is designed the way it focuses on engagement, giving the younger generations what they demand: freedom of choice by offering multiple live betting options available most of the time. Bookmakers have the choice to use eSports odds feed and cater the rest internally or integrate iFrame where the majority of the workload is carried on by Oddin, including UI. We are having conversations with several LATAM-focused bookmakers so we hope Brazilian users can enjoy eSports betting the way it is supposed to be soon!

Source: Exclusive GMB