FinCEN (Financial Crimes Enforcement Network) mission is to safeguard the financial system from illicit use, combat money laundering and its related crimes in USA.

By 2019, FinCEN’s Director Kenneth A. Blanco was a Keynote speaker at the 12th Annual Las Vegas Anti-Money Laundering Conference remarking FinCEN’s trends in AML fight in the casinos industry:

The Impact of Advanced Technologies

Casinos and card clubs know as well as any financial institution the important role technology can play in detecting and reporting financial crimes. This type of information is useful to a number of different law enforcement agencies and that the information is routinely run through federal databases to identify potential criminal activity. Blanco also talked about the use of innovation in AML technologies.

Sports Betting and Mobile Gaming

It is important for casinos and card clubs to consider how to integrate sports betting programs into their existing AML programs.

FinCEN expects that casino or card club- monitor sports betting programs for potentially suspicious activity. This includes offering sports betting through a mobile app.on an ongoing basis.

“You must establish and implement procedures for using all available information to detect and report suspicious transactions or suspicious patterns of transactions that occur through mobile sports applications,” commented Blanco.

Relevance of Convertible Virtual Currency (CVC) Advisory to Casinos

For casinos and card clubs accepting CVC from customers either on location or through your mobile applications, you need to ensure that this is accounted for in your policies, procedures, and internal controls—as well as your risk assessments. You should also consider how you will review and conduct due diligence on transactions in CVC. How will you conduct blockchain analytics to determine the source of the CVC? How will you incorporate CVC-related indicators into your SAR filings as appropriate?

Culture of Compliance

Fincen’s director spoke out to the audience in the sense that the culture of compliance that impacts every aspect of the gaming experience.

Budget cuts by casinos looking to trim costs and retain gamblers is seen by FinCEN as a national security issue and should be taken seriously.

“We know the kind of significant information that casinos are able to develop on gaming customers. This information is extraordinary and relevant and is already used by casinos for a variety of marketing and other business purposes.”

This information can and should be used by your compliance personnel as they monitor customers for suspicious activity.

“More importantly, a strong culture of compliance promotes breaking down traditional communication and information silos. You need to talk to people other than your compliance people”.

Basically, this mean that the different departments that operate, market, promote, and monitor gaming activities should all be exchanging information.

Under the AML program rule for casinos and card clubs, is compulsory the use of available information and automated data processing systems to aid in ensuring compliance.

Fincen’s Casino and Cards Club Statistics

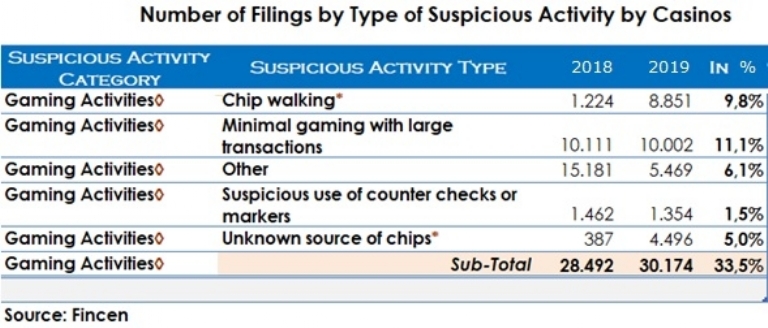

Blanco shared some Casino Industry Trends in terms of suspicious activity reports in 2019. Next exhibit shows number of SAR Filing by type from Casinos and Cards Clubs.

For a better understanding I explain some category activities.

Structuring: Alters or Cancels Transaction to avoid suspicious activity reports (SAR), or Transactions below recordkeeping threshold of USD 10.000.-

Other suspicious activities: Suspected public/private corruption (domestic or foreign), bribery, two or more individuals working together to cash out a portion of the chips or tokens won to avoid the SAR filing.

Gaming Activities: I break down this category in the following exhibit which represents the 33,5% out of the total categories.

A new Red Flag warning: Chip Walking

There is a particular activity that has come to the attention of FinCEN and federal law enforcement as a potential "red flag" of suspicious activity, called "chip walking."

According to the American Gaming Association (AGA) definition, of Chip Walk:

“When a patron leaves the casino floor with a significant amount of chips in their possession without offsetting chip redemptions or chip buy-ins at another table, and there is no known disposition or whereabouts of the chips.”

Even though the fact that there may be legitimate reasons for customers to do this, but it also could be a sign that the customer is trying to hide funds or structure cash transactions or use the chips and use them as a payment currency for illegal activities.

This has direct relationship with other suspicious activity type which is the unknown source of chips.

Federico Lannes

Certified Public Accountant, (MBA) Master in Business Administration at (INCAE/Harvard). Member of the Institute of Internal Auditors USA (IIA), Actual General Manager at Gran Nobile Hotel and Convention in Paraguay.