Exclusively for GMB, President Rodrigo Alves, founder of APOSTAFC and director of content at Eightroom, stated that the document is already in possession of members of the Secretariat for Economic Reforms and the Executive Secretariat of the Ministry of Finance. According to him, "the team was very open and solicitous to our considerations and suggestions."

"In a next step, we will hand them a study with more propositional notes on the tax issue itself, since we understand that the good practices of regulated international markets do not tax the bettor on his winnings. Therefore, we will take more detailed suggestions to the Ministry of Finance on how taxation should fall only on the operator, but in a way that does not burden them and is sustainable,” says Alves.

The document has details of the segment and comparisons with other already regulated jurisdictions, including demonstrating the need for regulation to take into account issues such as taxation, responsible gaming and consumer protection. In addition, it presents the main differences between sports betting and conventional lotteries, as well as in relation to casino games, in order to distinguish all these modalities.

Regarding the taxation of gamblers, the document is clear in indicating that one cannot compare the taxation of sports betting along the lines of what happens with lotteries. “This is not the best practice, and it would be even worse if there were indiscriminate taxation on all winning bets, regardless of the value of the prize, and with an immutable and pre-established percentage,” describes the ABAESP document.

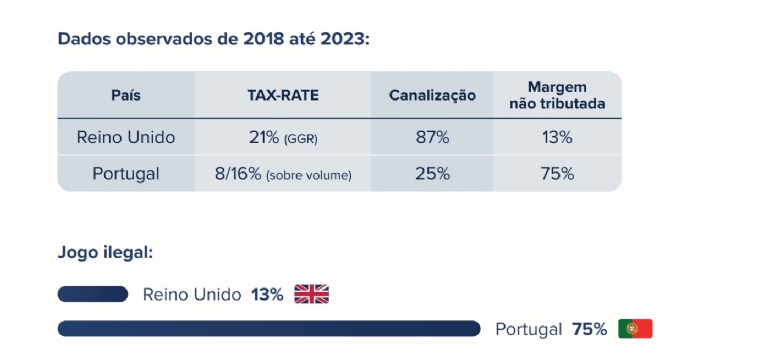

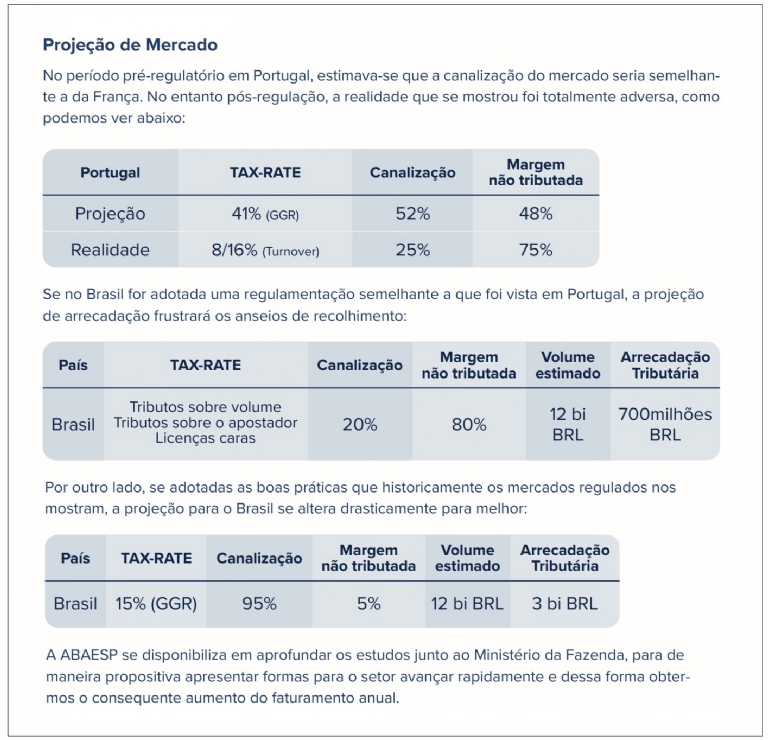

Specifically with regard to taxation of gamblers, the study shows comparisons between the rates applied in some countries, detailing how much a higher incidence of taxes causes the migration of gamblers to the illegal market or to sites outside their jurisdictions.

In this regard, ABAESP points out that “to combat illegal gambling, it is first necessary to understand that sports betting is not a lottery and that the common gambler receives prizes equivalent to what he bets. This bettor should not be taxed on his profits from betting, as that profit actually has about a 97% chance of being a loss, as gamblers lose more money than they win. That is, taxing on the profits it holds during its operations is unfeasible, as it would be the same as taxing losses.”

Cost of licenses

The association is also critical of the cost of licenses, estimated at R$ 30 million with a five-year validity, “which is an exaggerated amount in relation to other regulated jurisdictions.” The document demonstrates that in order to achieve channeling and actually achieve the expected volume, “it is necessary to adjust to good market practices, where the annual cost of the license is proportional to the GGY (Gross Gaming Yeld - gross earnings of the operator minus the value paid for prizes).”

In the document, ABAESP describes margins that can be applied to the activity and return on tax collection, demonstrating that if Brazil adopts the good practices of well-regulated markets, it could reach, according to the studies, something around R$ 3 billion in taxes against no more than R$ 700 million if the license is very expensive and if both the bettor and the operator are taxed on the volume of bets, due to the migration to the illegal market.

Another concern of the entity is about the vacuum of rules on advertising that affects sports betting, indicating that all advertising content should raise awareness of the public / final consumer considering educational and constructive content instead of simple “opportunistic advertising content.”

Good habits

The entity points out that sports betting can provide the country with several benefits, such as attracting foreign investment, job creation, legal security and tax collection by the State. “However, such benefits will only materialize if the regulation of the activity is carried out effectively and in compliance with the best international practices.” And it points out some of these best practices:

*No taxation of the bettor through winning bets.

*Sports betting with specific and independent legal and tax treatment, not to be confused with lottery or other types of games.

*Guarantee of a variety of sports betting products, including pre-match betting, live betting, entertainment betting, eSports betting, and betting exchange (exchange / Sports Trade), among others.

*Programs and tools for the prevention and monitoring of compulsive gamblers.

*Government and/or private entities that mediate conflicts between consumers and operators.

*Regulation and supervision of advertising and fake news, including celebrities, artists, influencers, and other opinion makers who promote betting as a means of guaranteed profit.

*Legal security and protection for affiliates.

*Supervision and monitoring of suspicious bets.

*Operator taxation on gross profit - GGR.

*Licensing system through authorization, with no limitation on the maximum number of operators, providing a wide market offer to the consumer.

*License cost as a way to guarantee the financial suitability of the operator, and not as a form of collection itself.

*Constitution of their own financial reserve by the operators as a way of guaranteeing the payment of the premiums earned.

*Legalization and broad regulation of the gaming sector, including casino games and other verticals.

At the conclusion of the contribution, ABAESP points out that “the success or failure of any regulation, as we have already observed in other countries that have already implemented it, permeates two pillars: the fair market, with competitive odds; and non-taxation on the gambler. Countries and jurisdictions that through regulation broke these two points, had a mass migration to the illegal market or capital flight to other countries.”

Source: GMB