The sports betting market has become increasingly attractive in Brazil, driven by the regulation of the sector in 2018. Since then, visits to websites of companies operating in this segment have grown significantly.

In addition, global trends also generate an impact, bringing innovations and transformations for bettors and companies that operate in the sector.

In this study, developed based on the analysis of the performance of 238 sports betting sites in 2022, Similarweb explores the main trends and performance of the segment in Brazil and worldwide.

Main results:

*Sports betting sites around the world received more than 14 billion total visits in 2022.

*Compared to 2021, the segment grew by +3.7%.

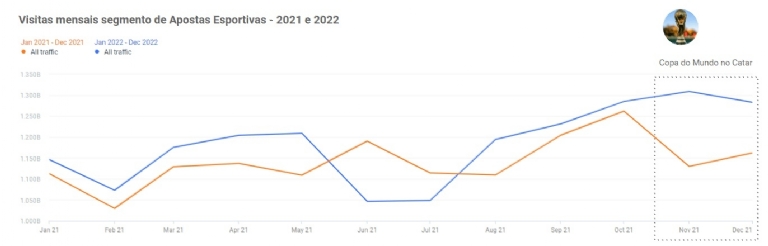

*The traffic peak of 2022 happened during the Qatar World Cup (November to December). Compared to the same period in 2021, growth was 15.8% in the games period.

In the world, the sports betting sector grew steadily in 2022

As seen above, the Qatar World Cup was responsible for the increase in traffic on sports betting sites around the world, showing a 15.8% growth between November and December, compared to the same period in 2021.

(Source: Similarweb, January – December 2022, desktop and mobile data, worldwide)

On the other hand, June to July 2022 were the months with the greatest drop in the volume of visits to these sites worldwide. Bet9ja and bet365 were the brands that most pulled this retraction.

Which players are conquering space in 2023?

F12.bet was the site that grew the most at the beginning of this year, and its main territory of operation was Brazil.

(Source: Similarweb, January – December 2022, desktop and mobile data, worldwide. Top Players and Rising Players: February 2023 data. Worldwide)

Brazil generated the highest volume of visits in the segment in 2022

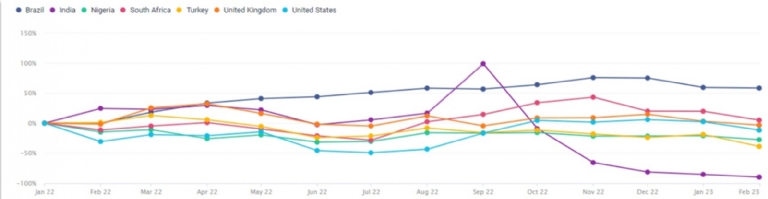

Between January and December 2022, Brazil had a 75% increase in visits to sports betting sites, demonstrating the great potential of this market.

(Source: Similarweb, January to December 2022, desktop and mobile data, worldwide)

Chile also deserves to be highlighted, being the country that grew the most in terms of visitor volume from January to December, with a growth of 100%.

India had the biggest drop in visits, with -89.7%, but still remains in seventh place in the ranking.

At the beginning of 2023, Brazil was the country that grew the most in visits, reaching a volume of 3.78 billion accesses accumulated since January last year.

(Source: Similarweb, January 2022 to February 2023, desktop and mobile data, worldwide)

Manoel Fernandes, jounalist and partner at Bites, a company that works with data analysis for strategic decision-making, adds that from January to March this year, the country maintained this leadership, reaching 11.4% of the audience, followed by India (8, 1%), Nigeria (8%), United States (5.1%) and United Kingdom (4.3%).

“The online sports betting market moved US$ 61.5 billion in 2022 worldwide. In 2028, the figures should reach US$ 114.4 billion. These numbers support the government's desire to regulate the activity in Brazilian territory, allowing better control of the ecosystem. The challenge is to create a solid and efficient regulatory framework that balances the interests of the government, operators and consumers, guaranteeing the integrity of sports, avoiding manipulation of results and illegal activities,” explains Fernandes.

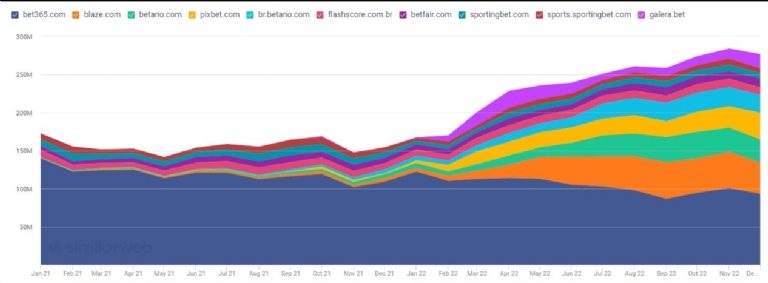

Regulation leveraged the market for sports betting sites in Brazil

Since 2018, when sports betting was legalized in Brazil, the market has been in continuous growth. And the World Cup stirred the segment even more, giving space for many brands to conquer space and make the scenario more competitive.

“Brazil is the main source of audience for ten of the 15 largest betting sites on the planet. On average, 49% of the traffic of these companies, which are currently awaiting regulation of their activities by the federal government, originates from Brazilian users,” comments Manoel Fernandes, partner at Bites.

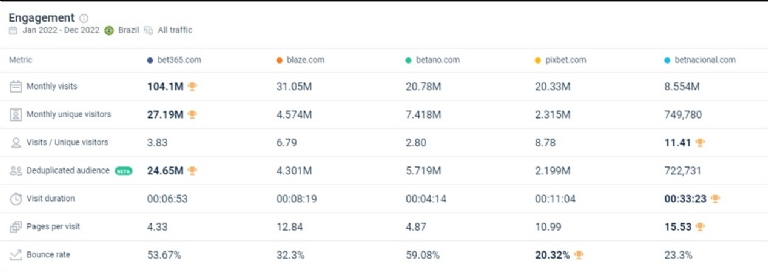

In total, there are 214 million visits per month, considering the last 12 months. That's a volume of 48 million people on websites alone (mobile apps are not included in this analysis).

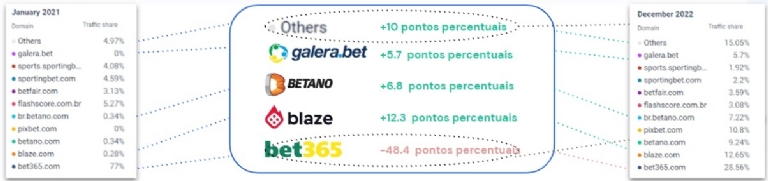

Bet365 had a reduction of 48.4 percentage points throughout 2022, with the arrival of new players in the country.

Betnacional stood out in terms of engagement, with visits lasting 5.5 times longer than Bet365 and a rejection rate that was one third of the competitor's.

(Source: Similarweb, January 2022 to February 2022, desktop and mobile data, Brazil)

Regarding acquisition channels, organic search and recommendations were the main traffic drivers. Among Bet365 users, 1 in 3 came through these means.

(Source: Similarweb, January to February 2022, desktop and mobile data, Brazil)

Although Betnacional has fewer referral domains than Bet365, the affiliate sitedeapostas.com proved to be a relevant partner by bringing more engaged users.

(Source: Similarweb, January to February 2022, desktop and mobile data, Brazil)

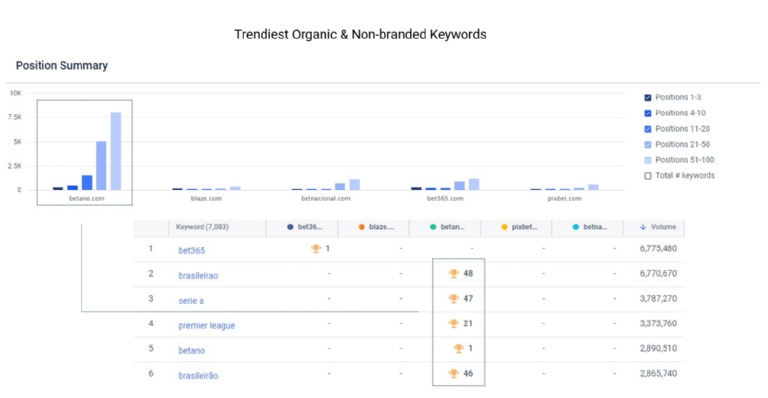

Betano was the leader in organic search, with the keywords that generated the most traffic in February 2023.

(Source: Similarweb, February 2023, mobile web data, Brazil)

Similarweb Methodology

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained by third parties, and include estimates and extrapolations based on such data.

Data and insights by: Vicky Almeida, Similarweb Insights Leader LATAM.

Review and text by: Cristiana Simon, Similarweb Content Leader LATAM.

Source: GMB / Similarweb