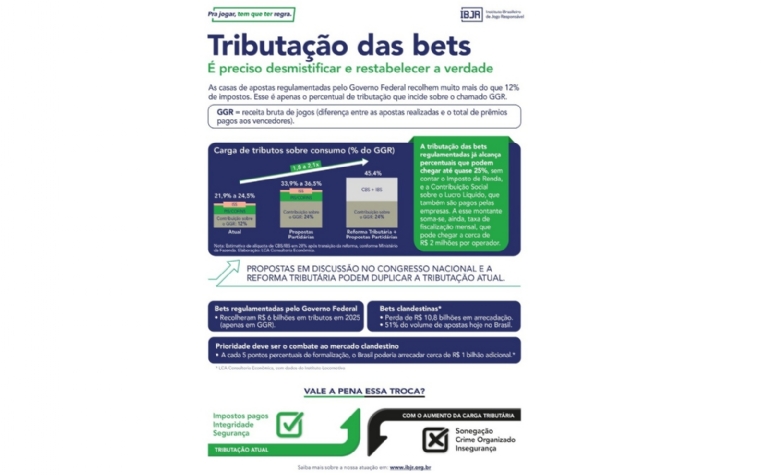

Currently, regulated betting operators are taxed at nearly 25%, considering the direct tax on GGR and other taxes applied to any economic activity in Brazil. This percentage does not include Income Tax (IR) or CSLL, nor does it account for the monthly supervision fee, which can reach R$ 2 million (US$370,000) per operator.

The infographic analyzes the legislative proposals under discussion in Congress, particularly the bill that seeks to raise the GGR tax from 12% to 24%, which was granted urgent status on October 22 and may go to a plenary vote at any moment.

If approved, the bill would bring the total tax burden on betting operators to between 33.9% and 36.5%, plus IR and CSLL, making operations even more challenging for a market that has only recently been regulated and has already contributed nearly R$ 7 billion (US$1.3bn) to public coffers since the beginning of the year.

The situation could worsen further with the implementation of the tax reform, as the combined rate for the Contribution on Goods and Services (CBS) and the Tax on Goods and Services (IBS) is expected to reach 28%, pushing the overall tax burden on ‘Bets’ to over 45%.

According to the IBJR’s infographic, the regulated sector has already paid over R$ 6 billion (US$1.1bn) in GGR-related taxes since the start of formal operations, while illegal betting platforms still account for more than 50% of Brazil’s betting market. Based on data from LCA Economic Consultancy and the Locomotiva Institute, the estimated revenue loss in 2025 could reach nearly R$ 11 billion (US$2bn).

For this reason, the IBJR advocates maintaining taxes at their current level and argues that the priority should be to combat the illegal market. The infographic notes that for every 5 percentage points of market formalization, Brazil could generate around R$ 1 billion (US$185m) in additional tax revenue, according to the same LCA/Locomotiva study.

The Institute warns that higher taxes could stimulate the illegal market, increase tax evasion by unlicensed operators, and even foster links with organized crime.

“IBJR remains committed to disseminating accurate, data-driven information about the regulated market,” the organization stated.

Source: GMB