The regulated betting market in Brazil has brought a paradox for operators. Never has there been a better time to grow in the sector — yet never has the risk of a poor onboarding experience been higher.

Law No. 14,790/2023 clearly defines verification requirements that, if poorly implemented, can destroy conversion rates. On the other hand, neglecting them means heavy fines and the risk of losing your license.

The six mandatory verifications under the law (and the complexity behind each one)

The regulation establishes six specific checks during user registration. Each involves complexities that manual processes simply can’t handle at scale.

1. CPF (Individual Taxpayer Registry)

It’s not enough for the CPF to exist — it must be active with the Federal Revenue Service, show no record of death, and the user’s data must match the official database perfectly. A single accent mistake in the name or a swapped birthdate digit? The system must catch these inconsistencies before they become bigger issues.

2. PEPs (Politically Exposed Persons)

Identifying a PEP is already a challenge, but it also requires tracing second-degree relatives — parents, grandparents, children. If anyone in that family tree holds a significant public office, they must be flagged. These lists change constantly with elections, appointments, and dismissals across all levels of government.

3. AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism)

This involves international watchlists: OFAC (U.S. Office of Foreign Assets Control), UNSC (United Nations Security Council), Brazil’s COAF (Financial Activities Control Council), and negative media sources. Missing a single list can mean million-dollar fines. And it’s not enough to check one — the process requires cross-referencing multiple data sources simultaneously.

4. Links to betting operations

Employees of betting companies can’t place bets. Simple as that. The challenge is identifying who works where. This requires access to data from the Federal Revenue Service, commercial registries, and employment records — including close relatives.

5. Links to the Regulator (SPA)

Anyone working for the regulator is also prohibited from betting. The logic is that access to privileged information invalidates any wager. Identifying these individuals demands direct integration with specific government databases.

6. Sports links

Eight sports (football, basketball, handball, volleyball, tennis, MMA, chess, and table tennis) — male and female categories — including athletes, referees, coaches, and executives. Not just the bettor, but also their second-degree relatives.

This requires cross-checking data with the CBF, sports confederations, state federations, and even international entities. Manually, such verification could take days. Automated, it takes seconds.

The framework that solves the problem

The question isn’t whether to perform these verifications, but how to do so without making users abandon the onboarding process. The answer lies in three simultaneous technical layers:

1. Simplified input

The user sees only what’s essential: name, CPF, birthdate, document photo, and selfie — nothing more. The cleaner the form, the lower the friction.

2. Parallel processing

As soon as data is submitted, six checks run simultaneously. OCR extracts document info, biometrics validate the selfie, APIs connect to the Federal Revenue Service, AML lists, company records, SPA data, and sports links — all in parallel, not sequentially.

3. Intelligent Decisioning

A rules engine analyzes the results and decides: approved, rejected, or sent for manual review. Approved users can deposit immediately. Suspicious cases go to human review — without blocking the entire operation.

The user doesn’t see any of this. For them, it’s fast and seamless — and that’s exactly what keeps conversion high.

What changes when you automate

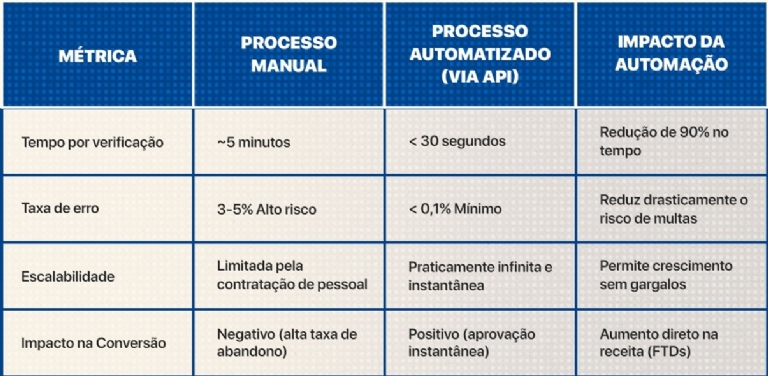

Manual processes kill operations in three ways: cost, time, and error.

A manually verified registration takes 3–5 minutes. Via API, less than 30 seconds — and that’s the difference between converting or losing a user.

Operational costs drop drastically. Manual verification is expensive, while automated checks cost pennies per API call. At scale, this easily saves hundreds of thousands per month.

Then there’s human error. Manual checks have an error rate between 3% and 5%. Automation cuts that to below 0.1%. Every avoided error means one less fine — and one less compliance issue waiting to escalate.

But the most direct impact is on conversion. Slow onboarding drives abandonment. Instant verification boosts FTDs (First Time Deposits). More deposits mean more active players — and more revenue. Simple as that.

Frictionless implementation: the ideal flow

If your operation still depends on manual processes, the path forward has three steps:

1. Honest diagnosis

Map your bottlenecks. How long does each verification take today? Where do users drop off? What’s the real cost per approved registration? Without those numbers, you’re flying blind.

2. Integrated solution

Forget juggling five separate vendors you need to stitch together manually. The ideal solution comes with all APIs integrated, intelligent orchestration, and parallel processing. You want plug-and-play, not a technical puzzle.

3. Transparent experience

If users notice the technical complexity, you’ve failed. The solution must be invisible. What they should feel is speed and smoothness — not digital bureaucracy.

Compliance that accelerates, not blocks

Regulation shouldn’t be treated as an obstacle. In fact, it separates those ready to scale from those still improvising.

While operators reliant on manual processes make users wait 5 minutes, lose conversions to friction, burn money on per-registration costs, and operate with 3–5% error rates, automated operators approve in under 30 seconds, turn onboarding into a competitive edge, slash verification costs, and maintain over 99.9% accuracy.

Brazil’s iGaming market is just getting started. The operators who master onboarding today will dominate the next decade.

Automation is no longer optional — it’s the standard for safe, scalable growth.

Fernando Hoppe

Head of Marketing at Legitimuz, an integrated management and compliance platform fully aligned with Law No. 14,790/2023.

The solution combines advanced KYC with OCR and facial biometrics, real-time transaction monitoring to prevent money laundering (AML) and terrorism financing (CFT), and geolocation with VPN/proxy detection.

With integrated APIs and parallel processing, the platform automates all six mandatory checks — enabling operators to scale their operations with full compliance, lower costs, and frictionless onboarding.