The Febraban congresses have long been the most relevant forums when it comes to anti–money laundering (AML) and counter-terrorist financing (CTF). The event held a few days ago in São Paulo only reinforced that leading position.

For years, the financial sector has been deeply engaged in this topic, consistently offering valuable insights that often set the tone for other industries. This year’s edition revolved around three major themes: betting, artificial intelligence, and reports to the Financial Activities Control Council (Coaf).

‘Bets’ take center stage in the discussions

I’ll start with betting—not just because of alphabetical order, but because among the three topics, the betting market was by far the most discussed at the Febraban Congress 2025.

It’s worth noting a very significant change within the banking sector. Although some criticism of online betting remains, the tone has shifted considerably. The financial world is increasingly moving past certain biases and beginning to understand betting operators as service providers that depend entirely on the financial system.

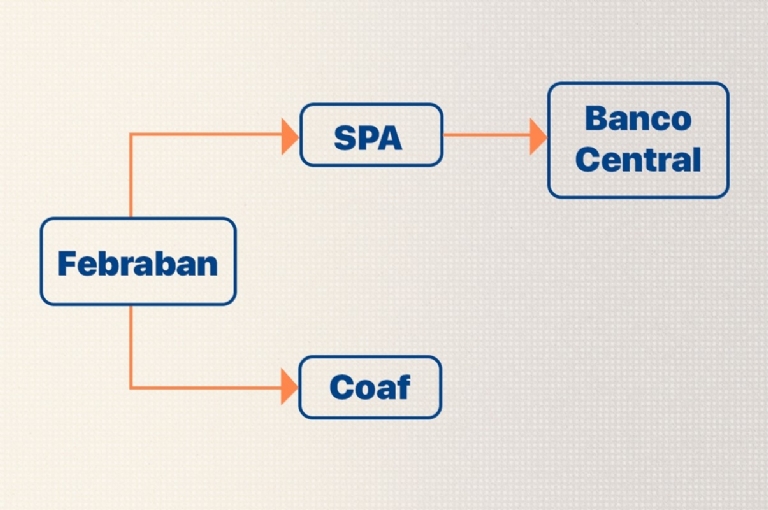

The shift in perspective has been so substantial that major banks no longer frown upon the fact that the Secretariat of Prizes and Betting (SPA) has, in a way, become a regulator for them.

To be clear, financial institutions, payment institutions, and payment arrangements remain under the supervision of the Central Bank, nothing has changed in that regard.

However, since the publication of SPA/MF Ordinance 566/2025, these institutions are now required to report to the SPA any clients operating in the illegal betting market. Moreover, they must terminate any financial transactions linked to unlicensed betting operators.

As a result, financial institutions began following specific SPA rules to combat illegal betting, an issue widely covered by the media this week.

New obligations for payment institutions in the fight against illegal ‘Bets’

Payment institutions now face three new obligations when dealing with unlicensed operators:

1. Identify illegal betting operators

2. Report them to the Secretariat of Prizes and Betting

3. Block any financial transactions with such platforms

A turning point: from combating ‘Bets’ to combating the illegal market

Another notable shift highlighted at the Febraban congress was the understanding that the real issue in the betting market does not stem from SPA-licensed operators, but from the illegal market. Banks have finally recognized this distinction and positioned themselves as allies in the fight against unlawful activity.

This new stance represents a significant step forward, showing maturity and a strong commitment not only to combating money laundering but also to protecting society.

Even though the focus is on illegal operators, some messages were also directed at licensed ones. One of them: it’s crucial to strengthen AML, compliance, and anti-fraud teams. Operators need to invest in:

* KYC (Know Your Customer)

* KYP (Know Your Partner)

* KYE (Know Your Employee)

* KYS (Know Your Supplier)

This “alphabet soup” is essential to mitigating vulnerabilities in the online betting sector.

Reports to Coaf in iGaming: Quantity has grown—but what about quality?

So far, Coaf has observed that suspicious transaction reports from the regulated betting market —nearly ten months after regulation— show patterns similar to other obligated sectors.

The reports of suspicious transactions that have been received generally include:

* Structuring of withdrawals and deposits

* Use of “straw” accounts

* Betting amounts far above the bettor’s income

When I left the SPA in mid-April, the fixed-odds betting (AQF) sector had filed roughly 500 reports to Coaf. By October, that number had already exceeded 2,000.

That’s quite a lot—but as we all know, quantity doesn’t always mean quality, and in the case of betting-related reports, this saying has proven true.

There has been progress, no doubt, but some reporting challenges persist within Brazil’s Financial Intelligence Unit (UIF). The good news is that Coaf has shown great openness and willingness to engage in dialogue with the betting sector.

The necessary alliance: financial institutions and licensed ‘Bets’ united against illegality

The Febraban congress made it clear that collaboration between financial institutions, regulators, and betting operators is essential for the market’s maturity. The banking sector’s shift in perspective—recognizing regulated operators as partners in combating illegality—marks a significant turning point.

To support this movement, the Legitimuz team recently held an enriching discussion on best practices for reporting to Coaf last August—and plans to repeat the event later in 2025.

With this collaborative environment taking shape, who knows—perhaps Febraban might join as a partner in this initiative? It would be the perfect alliance to further enhance reporting quality and strengthen Brazil’s entire anti–money laundering ecosystem.

Fred Justo

Director of AML at Legitimuz