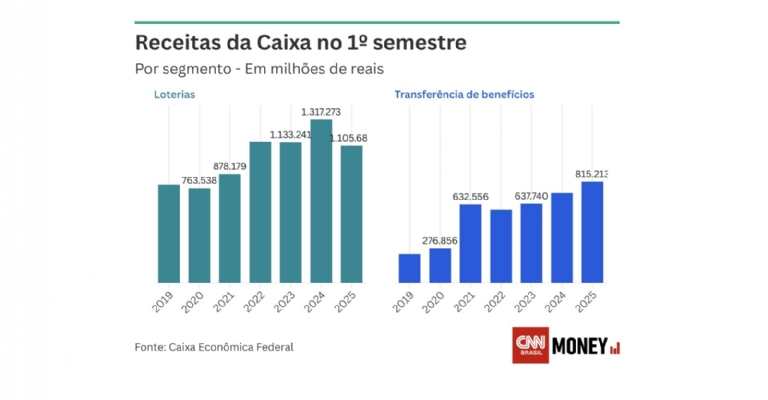

From January to June, the state-owned bank recorded R$ 1.105 billion (US$ 207m) in revenue from services provided through its network of 21,100 lottery retailers and “Caixa Aqui” correspondents — a drop of R$ 211 million (US$39m) in just one year.

This amount refers to the commission Caixa receives for holding the monopoly on federal lottery management and being the entity that authorizes the operation of lottery outlets. Once licensed, lottery agents may only offer Caixa services and products, operating within the bank’s fully controlled system.

The slump in lottery operations was briefly mentioned in Caixa’s latest financial report: “This performance is mainly due to a lower number of accumulated jackpots this year compared to the same period in 2024,” the Administration Report states.

Interestingly, despite this explanation, the same report notes that the total amount paid out in prizes actually rose 8.2% year-over-year, reaching R$ 4.3 billion (US$806m).

Social benefit transfers

At the same time, Caixa’s financial statements show a consistent increase in revenue from handling federal benefit payments. In the first half of 2025, the bank earned R$ 815.2 million (US$153m) from this line of business — a 12% increase compared to the previous year.

This revenue stream has been steadily growing since the pandemic. In 2020 alone, with the rollout of the Emergency Aid program, Caixa’s revenue from social benefit operations jumped 128%. Between 2019 and 2025, this segment surged 250%, adding R$ 582 million (US$109m) to Caixa’s balance sheet.

In 2025, Caixa has already paid out R$ 229.8 billion (US$43bn) in social benefits — either in cash withdrawals or direct electronic transfers. Altogether, 20.8 million people received some form of benefit through the bank.

The largest operation involves pension and retirement payments, totaling R$ 89 billion (US$16.7bn) in the first semester. Next come Bolsa Família (R$ 81.4 billion / US$15bn), unemployment insurance (R$ 31.1 billion / US$5.8bn), salary bonus (R$ 17.7 billion / US$3.3bn), and the new Pé-de-Meia program (R$ 6.4 billion / US$1.2bn).

When contacted, Caixa stated that the increase in the “benefit transfer” line stems from its expanded role in the New Growth Acceleration Program (PAC). The bank manages federal budget transfers for several ministries, including Cities, Health, Justice, and the National Education Development Fund (FNDE).

“The increase results from Caixa’s performance in managing cooperation agreements, where the federal government pays service fees for each transaction as they progress — up to a maximum of 2.5% of the transfer amount,” the bank explained in a statement to CNN.

Regarding other government service revenues, Caixa reported 882 new agreements signed, totaling R$ 4.8 billion (US$900m) in investments.

When asked about the decline in lottery revenue, Caixa declined to comment.

Source: CNN