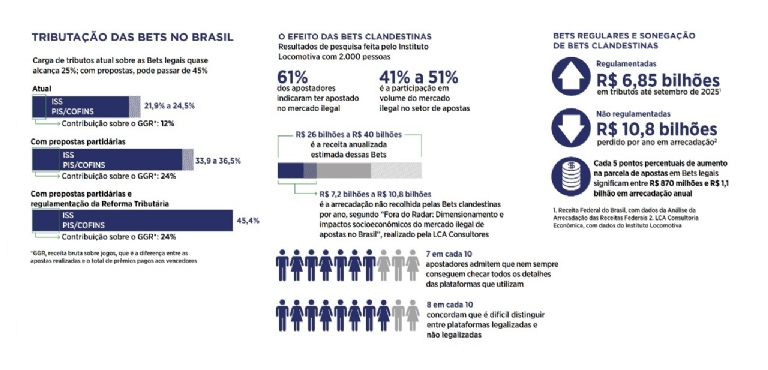

Raising taxes at this stage could destroy a market that has just been regulated — which collected R$ 6.85 billion (US$1.27bn) between January and September 2025 — and drive millions of bettors to illegal platforms involving minors, false promises, and match-fixing, says Gelfi. According to him, the path to increasing revenue and protecting citizens lies in combating illegality, which represents 51% of the sector, according to a study by LCA Consultoria Financeira.

What does the illegal betting market represent in Brazil?

Illegal operations still account for about 51% of the betting market, moving around R$ 38 billion (US$ 7bn) annually. This means the government loses R$ 10.8 billion (US$2bn) in taxes each year. Clandestine operators pay no taxes, follow no consumer protection rules, ignore integrity controls, and operate outside the financial system — harming consumers, distorting competition, and undermining the credibility of the industry.

What rules apply?

The regulated market follows clear rules to protect bettors and ensure legal security. It includes responsible gaming measures, such as time and spending limits, and tools to block underage access, including facial recognition, a pioneering measure in Brazil. It also promotes financial education to reinforce that betting is entertainment, not investment.

In addition, there is an Advertising Code, created in cooperation with Conar, which added a specific annex for betting communication. The illegal market, on the other hand, ignores all these rules and thrives on deceptive promises, match manipulation, money laundering, and organized crime.

How is the sector taxed?

Since January 2025, the sector has been regulated and supervised. The current total tax burden is about 25%, with a 12% tax on GGR (Gross Gaming Revenue) — the difference between total bets and prizes paid — plus PIS, COFINS, and ISS.

From January to September, licensed platforms generated R$ 6.85 billion (US$1.27bn) funding areas such as sports, tourism, security, and education. Every 5 percentage points of migration from the illegal to the regulated market represent between R$ 870 million (US$161m) and R$ 1.1 billion (US$204m) in additional tax revenue.

Therefore, combating illegality is the most effective way to increase revenue while protecting society and providing market predictability.

What could happen if taxes increase?

The proposal to raise the sector tax from 12% to 24%, as in Bill PL 5.076/2025, would push the total tax burden to about 45.4%. This could make it unviable for many companies that have invested in licensing, technology, and compliance to continue operating in Brazil.

As Gelfi explains, this is still an early-stage market. A sudden change now would discourage investment, shrink the regulated base, and drive players to illegal sites. He cites international examples: in Germany, when the tax was applied to the bet amount, most users migrated to unlicensed websites, causing revenue loss and lower player protection.

How to fight illegal 'Bets'?

There are clear measures. First, all illegal operations use Pix, a system monitored by the Central Bank — which allows transactions to be tracked and blocked. It’s also necessary to hold influencers and digital platforms accountable for promoting illegal gambling, as most of this content circulates on social media, not in traditional media.

Another key front is the regulation and oversight of technology providers, penalizing those supplying games to unlicensed operators. Finally, clear communication: if the domain doesn’t end with “.bet.br,” the operator is not authorized by the federal government, and bettors should be cautious to avoid scams. Information and enforcement must go hand in hand.

Responsibilities of legal 'Bets' illegal ones do not meet

Taxation: taxes on operations and winnings.

12% on GGR (Gross Gaming Revenue)

PIS/COFINS and ISS, raising total consumption taxes close to 25%

15% income tax on bettors’ net winnings

Registration: mandatory registration in Brazil, with at least 20% local ownership and compliance with corporate regulations.

Restrictions and verification: access banned for minors, public officials, and individuals with potential influence over sporting outcomes. Identity verification must include biometrics or facial recognition.

Licensing and guarantees: payment of R$ 30 million (US$5.6m) for a five-year license and maintenance of a R$ 5 million (US$929,000) guarantee account to ensure obligations with consumers and the state.

Advertising: restrictions on target audience, language, and format, including mandatory responsible gambling messaging.

Source: IBJR / Estúdio Folha