Alongside the benefits for the country, the rules in place reinforce consumer protection through strict control mechanisms and campaigns promoting Responsible Gaming.

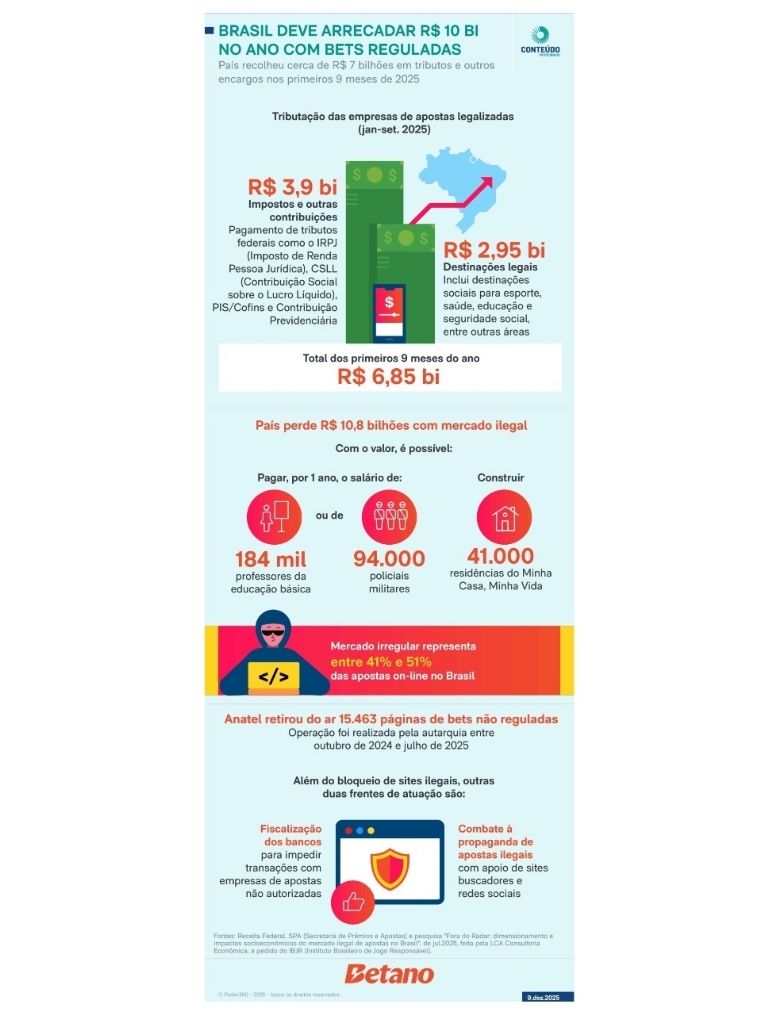

Regarding fiscal contribution, data from the Federal Revenue Service shows that in the first nine months of 2025 alone, regulated bets generated R$ 6.85 billion (US$1.25bn) in tax collection. Part of this total was directed to taxes and contributions, while another share funded areas such as health, education, and sports, as provided under Law 14,790 of 2023.

According to Betano’s Commercial Director, Guilherme Figueiredo, the data demonstrates the strength of the market not only as entertainment but also as a source of funding for key areas of the economy. “It’s a positive impact that tends to grow as the market matures,” he said.

The amount allocated to various sectors could be even higher. Due to illegal betting operations, the country loses R$ 10.8 billion (US$2bn) per year, according to figures released by the Brazilian Institute for Responsible Gaming (IBJR). In comparison, this amount would be enough to pay the annual salaries of up to 184,000 primary school teachers or 94,000 military police officers. It could also fund the construction of up to 41,000 homes under the Minha Casa, Minha Vida program.

Awareness as a priority

To ensure that gambling-related revenues are legally directed — something only a regulated operator can guarantee — players must pay attention to certain details to confirm they are accessing a platform expressly authorized by the Secretariat of Prizes and Betting (SPA), an agency linked to the Ministry of Finance.

The first sign appears immediately: a regulated betting operator uses a “bet.br” domain (not “.com” or any other). In addition, facial recognition is required for users to log in — a useful feature for those using mobile devices, where the URL may not be visible. To access the platform, users must log in and upload a photo ID.

“We are the only country in the world with facial recognition, which practically prevents minors and fraudulent players from participating. Previously, users created fake accounts using bots, and we had no way to control this,” said Guilherme Figueiredo.

The company has been reinforcing this information. A market leader with a 23% market share, Betano was the first fixed-odds sports betting operator to become regulated and has invested in internal and external Responsible Gaming policies since 2013, the director said.

Among the main solutions adopted is an internally developed AI designed to identify potentially excessive gambling patterns.

Betano’s platform also features a customer account section to set limits for losses, deposits, and bet volume. On the app and website, players can establish the time they spend online and even self-exclude — meaning the account is permanently deleted and cannot be recovered.

In July 2025, the company strengthened its public awareness initiatives with the launch of the “Não Mete o Loco” campaign, featuring former Uruguayan footballer Sebastián “Loco” Abreu. The campaign aims to highlight the entertainment purpose of betting and promote safe practices such as setting time limits, recognizing when to stop, and respecting one’s budget.

“The campaign was very well received because we used a creative approach. We needed something engaging to draw attention to the issue and, more importantly, to guide people to a platform where they can find all the information about safe gambling,” explained Arthur Niggemann, Senior Marketing Manager (Americas) at Betano.

Rules also apply to payments

As of mid-September, Brazil had 182 legalized platforms, which can be verified on the Ministry of Finance’s website. The information was provided by the SPA through its communications office following a request from Poder360.

The agency emphasized that only online betting companies authorized by the SPA can operate nationally. By law, platforms cannot accept deposits from unregistered accounts, nor can they make payments or offer prizes in cash or via bank slips. Only Pix or debit transactions are allowed. The sector also maintains a credit guarantee fund similar to those used in the banking industry.

“In this fund, part of all taxes paid by these companies is reserved. If a regulated operator ‘breaks’ or fails to meet its obligations to players for any reason, those consumers will be protected,” said Figueiredo.

Players must also provide a bank or payment account registered in their own name, which will be used for both deposits and withdrawals.

The road to legalization

Although betting was legalized in 2018 under Law 13,756, regulation was only approved in 2023 through Law 14,790. The regulation, in force since January 1, 2025, served as the basis for the rules outlined in SPA/MF Ordinance No. 827 of 2024.

The rules address combating tax evasion, money laundering, and the use of platforms by minors under 18. Each operator receives authorization to use up to three different brands, meaning a single company may operate up to three distinct websites, each with its own name and identity.

For consumers, aside from the “bet.br” domain, another way to verify whether an operator is legal is through betalert.com.br, developed by IBJR as part of the “Chega de Bode na Sala” campaign. Users simply enter the brand name into the search bar.

Research shows challenges

Awareness campaigns have helped the public, as distinguishing between legal and illegal operators remains a challenge. According to the study “Off the Radar: Scale and Socioeconomic Impacts of the Illegal Betting Market in Brazil,” conducted by Instituto Locomotiva, eight in ten bettors say it is difficult to make this distinction.

Among those surveyed in the study, published in July, 70% said they cannot always check all details of the platforms they use, and 61% admitted to having bet on the illegal market.

“It’s also important to pay attention to the login process. If it’s too simple and doesn’t require facial recognition or geolocation, that may indicate the platform is illegal,” Figueiredo added.

The study shows that illegal operators use several tactics to attract players, including brand names similar to regulated companies, prohibited payment methods, frequent domain changes, email phishing, and influencer marketing.

The research estimates that illegal operators account for 41% to 51% of the Brazilian market. The country has more unlicensed betting operators than places like the U.K. (3%), Italy (6%), and Portugal (21%).

Legalization at stake

In just the first half of this year, the federal government initiated 66 inspection processes against 93 companies, resulting in 35 punishments. Additionally, from October 2024 to June 2025, the National Telecommunications Agency (Anatel) removed 15,463 illegal betting pages from the air.

According to Figueiredo, Brazil has already made significant progress in oversight. The next steps, he argues, should focus on strengthening legal certainty. “Regulation has worked in Brazil, and now what we need is legal certainty to ensure that the base of legalized companies remains stable over time.”

With these advancements, major components of the market will consolidate, he says. This is because regulated bets can no longer offer financial bonuses to attract new users, which will change player behavior.

“Previously, it was easy to open an account, and ‘deposit and get’ incentives encouraged users to sign up with several operators to claim bonuses. Today, since that no longer exists and account requirements are stricter, users tend to choose fewer betting platforms, which leads to consolidation,” Figueiredo said.

Regarding the future of the market, Niggemann also predicts a more stable environment. “Brazil is one of the most promising sports betting markets in the world. As regulation becomes more stable, we see a scenario of sustainable growth, with more responsibility, investments in technology, job creation, and initiatives connected to sports and entertainment,” he concluded.

Source: Poder360