The rise of betting companies in football sponsorships has triggered a mass exit of brands from other sectors. Pharmaceutical and food industries, as well as public companies and banks, have lost ground and no longer hold prominent positions on team jerseys.

According to experts interviewed by g1, betting companies are deliberately reinforcing brand presence in a highly homogeneous market where it is difficult to stand out from the competition. Moreover, the very nature of the betting business allows for advertising investments far greater than those seen in other industries.

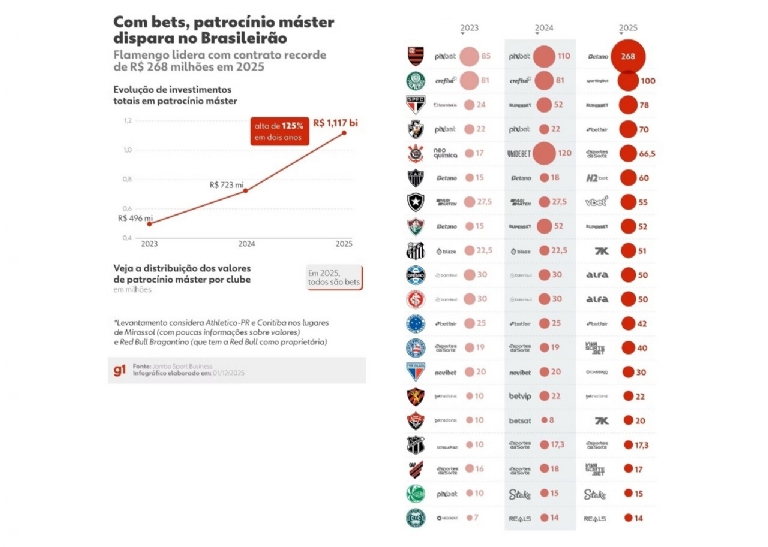

Currently, Flamengo holds the most valuable main sponsorship in the country. According to the report, the club — which boasts Brazil’s largest fanbase — is expected to receive R$ 268 million (US$51m) from Betano in 2025. This is the highest amount ever recorded in Brazilian football.

Brazilian and Libertadores champion in 2025, Flamengo also posted the largest absolute increase in sponsorship revenue over the past two years, a jump of 215%. In 2023, the club earned R$ 85 million (US$16m), rising to R$ 110 million (US$21m) in 2024.

The record figure for 2025 was reached after the club replaced PixBet, previously displayed on its shirt, with Betano.

What’s behind the strategy?

Investing in main sponsorships reveals a common marketing practice: reinforcing the brand to gain credibility and consolidate market presence. In this context, sponsoring a major football club works as a tool to remain permanently in the public’s memory.

In the betting market, this tactic becomes even more relevant. Since betting companies show little differentiation among themselves, explains Idel Halfen — a marketing specialist and one of the authors of the study — sponsorship becomes a way to stand out.

“'Bets' are like a commodity: the product is the same. The only things that change are the deposit amount, the bonus, or the payout speed. That’s why brands seek visibility,” he says.

Beyond keeping the brand top-of-mind, companies also use main sponsorships to convey solidity. “If a brand sponsors a club, it is perceived as strong,” he adds.

Betting companies also rely on influencers for targeted campaigns and adopt “ambassadors” for long-term partnerships — both key strategies for reaching their target audience and generating quick results.

Why are the amounts so high?

The “inflation” in sponsorship fees caused by betting companies has several explanations. The main one is that these businesses allocate a much larger portion of their resources to marketing and advertising compared to traditional sectors — largely because their operational structure is far less costly.

Companies in the productive sector, for example, must invest heavily in research, development, production, inventory, logistics, and distribution. Betting platforms do not face these costs.

“This directly impacts profitability,” says Marcelo Toledo, professor of sports marketing at ESPM’s business administration school. “When looking at a betting company, the largest departments are marketing, development, and compliance — the latter due to regulatory requirements.”

As a result, and backed by significant profits, the sector can allocate increasingly larger sums to brand building, particularly through main sponsorships. In practice, this increased demand pushes clubs to raise their asking prices for the most valuable spot on their uniforms.

“It’s a matter of supply and demand. Many companies want to sponsor all 20 teams in the Brasileirão,” Toledo notes.

He adds that billion-real investments would naturally emerge as audience numbers rise and new digital media formats for match highlights and content appear — but betting companies accelerated this trend.

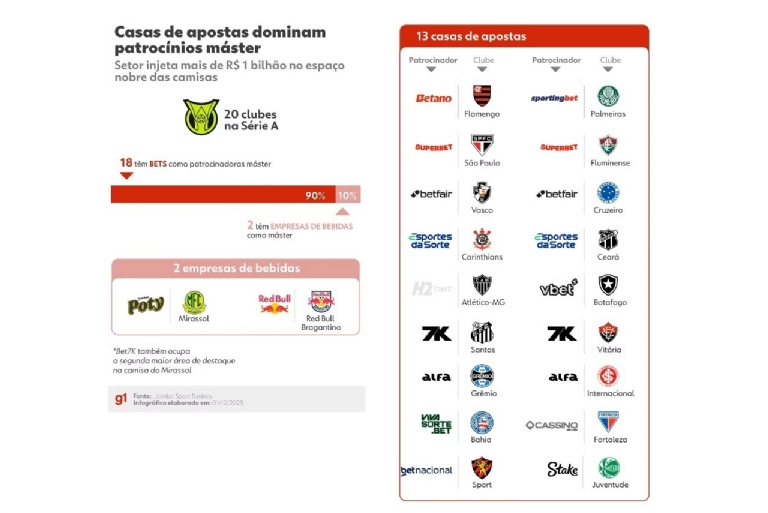

To illustrate, 18 of the 20 Série A clubs currently have betting companies as main sponsors. The only exceptions are Red Bull Bragantino — sponsored by its own beverage brand — and Mirassol, which features Poty as its main sponsor. Still, the São Paulo club also holds a major sponsorship deal with 7K, part of the Ana Gaming group.

How betting companies “pushed out” other brands

Idel Halfen, who has led marketing teams for major corporations — including a top-tier Brazilian football club — points out that the multimillion-real investments from betting companies have made main sponsorships almost unattainable for most other industries.

He cites Flamengo’s R$ 270 million (US$51m) expected payout for 2025 as an example.

“Some betting companies are investing nearly R$ 300 million in a single football club. For many large corporations, that amount equals their entire marketing budget — including research, advertising, and all other activities,” he explains.

Additionally, marketing directors must justify the investment to CEOs and show tangible results. In this regard, betting companies enjoy an advantage: TV exposure can generate immediate and measurable betting activity, whereas in other sectors the return is far less clear and takes longer.

“For banks, for example, it’s hard to prove that a sponsorship led to concrete results,” Halfen notes.

A strategy influenced by political and social context

Economic, social, and political factors — as well as consumer habits — also shape main sponsorship trends. In the 1990s, Coca-Cola heavily invested in football sponsorship, something rare today. Parmalat also left its mark during the decade by sponsoring Palmeiras.

In 1992 alone, Coca-Cola sponsored 70% of Brazil’s top-tier clubs, according to Jambo Sport Business. A similar pattern emerged in the financial sector during the 2010s: between 2013 and 2018, banks dominated main sponsorships, accounting for 80% of the total.

Caixa Econômica Federal was the standout, sponsoring 14 of the 20 Série A clubs in 2017. In the years immediately before and after, it still appeared on the shirts of 12 teams.

Among state-owned companies, Petrobras is another example, having sponsored Flamengo for more than two decades, from the 1980s to the 2000s. Experts note that such strategies often depend on political circumstances.

“In the case of state-owned companies, it depends a lot on political timing. It may be interesting for a government to put Caixa as a sponsor, for example. We saw something similar when BRB, Brasília’s state bank, also sponsored Flamengo,” says Halfen.

What to expect moving forward

At least two major developments could reshape the generous sponsorships offered by betting companies:

* A potential ban or restriction on advertising

* The consolidation of the sector

Marcelo Toledo believes that betting advertisements will eventually be banned — in the medium or long term — because gambling addiction is considered a public health issue. However, any such measure would depend on public support.

“Just like cigarette ads were banned and alcohol ads restricted, the government and Congress may adopt similar rules here, following the example of other countries. It will be a transition process for everyone,” Toledo says.

Congress is already discussing limits on betting advertising. In May, the Senate approved a bill — still pending in the House — banning athletes, actors, broadcasters, and influencers from promoting betting brands, though still allowing jersey sponsorships.

Under the proposal, ad campaigns would be required to include warnings about gambling addiction risks. Football clubs, which rely heavily on this revenue, oppose the measure and estimate annual losses of around R$ 1.6 billion (US$300m).

A relevant practical step has already been taken by the federal government: in October, the executive branch issued a rule banning betting using accounts tied to social welfare benefits.

For Idel Halfen, market consolidation should also curb high spending. He compares the situation to that of telecommunications companies, which initially invested heavily in advertising because they offered similar services.

“Once companies build a loyal customer base with a large user pool, there’s less need to burn so much money. As brands consolidate, the market stabilizes, reducing the need for aggressive spending,” he says.

Idel believes that, unlike in some European countries, a ban is unlikely in Brazil in the short term, partly due to the strong political influence of the betting industry.

“A strong public outcry would be necessary, since the sector’s lobbying power is huge. Even tax rates debated in Congress ended up much lower than they could have been — reinforcing the idea that a ban is unlikely anytime soon,” he explains.

“I believe only a major public movement, possibly triggered by scandals, could shift opinion. For now, I don’t see this happening,” he concludes.

Source: g1