Bringing together CMOs, department heads, specialists, and major operators, the event revealed new data on the market’s evolution and explored performance trends, player behavior, and the growing role of artificial intelligence in user acquisition and retention.

Participants described the event as a deep and extremely valuable immersion for professionals who work daily with traffic, data, and optimization.

The speed at which the market is evolving — driven by new regulatory standards and increasing brand competition — reinforced the importance of staying close to innovation and more efficient, scalable growth models.

Brazil among the global giants

One of the main highlights was the sector's economic impact. According to data presented, Brazil is already the 5th largest global betting market, with R$ 17.4 billion (US$3.2bn) in GGR in the first half of 2025 alone.

The growth since 2021 is impressive: +734%, placing the country as one of the most dynamic ecosystems in the world. Today, there are 82 active companies and more than 180 brands competing for space.

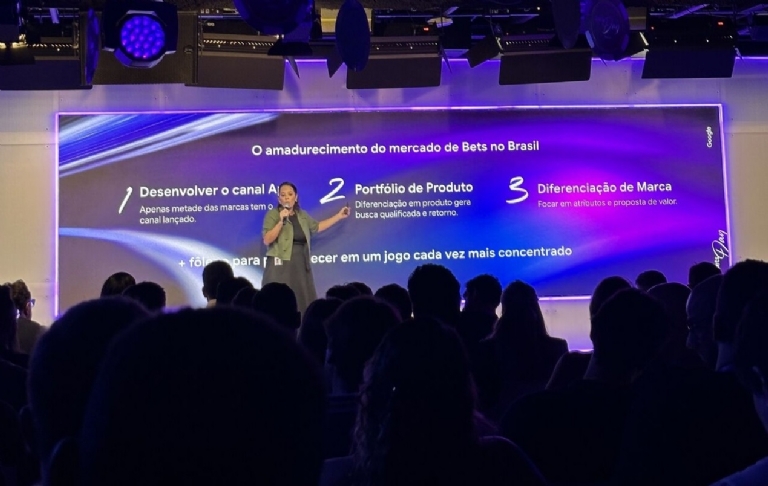

A market at an inflection point

Google noted that the sector has reached a new level: 2.8 billion monthly visits — double the volume recorded in 2024. This changes the entire logic of media, performance, and competitiveness, making operational efficiency a critical differentiator.

Websites remain the main channel for discovery and conversion, accounting for 90% of current traffic. However, app adoption is rising quickly and is expected to play a strategic role in the coming years, especially in the post-regulation environment.

Search maturity and user behavior

One of the most discussed insights was the evolution of search behavior. Today, 2 out of 3 searches related to the sector are about bets, reflecting a clear shift in audience intent. Additionally, 88% of these searches are brand-related, demonstrating more mature consumer preference.

The ten most searched terms include Betano, Bet365, Superbet, Betnacional, Esporte da Sorte, Betao, Sportingbet, Estrela Bet, Bet7K, and Vai de Bet.

Among the main reasons bettors search for brands, three categories dominate:

* Promotions and discounts – 37%

* Reliability and security – 26%

* Quality and best experience – 25%

These figures show that reputation and credibility remain decisive factors — including the growing weight of user reviews on platforms like Reclame Aqui.

Slots dominate; football remains unbeatable

In terms of product segmentation, Google showed that Slots and Crash Games already account for 51% of the market share, followed by Live Casino (36%) and sports betting (13%).

Among sports betting markets, Asian Handicap leads with 51%, followed by Double Chance and Cash Out.

Despite global diversification, Brazil maintains a strong particularity: 90% of sports searches are related to football, far above countries like Spain (74%) and Germany (67%). In a World Cup year, this trend is expected to intensify even further.

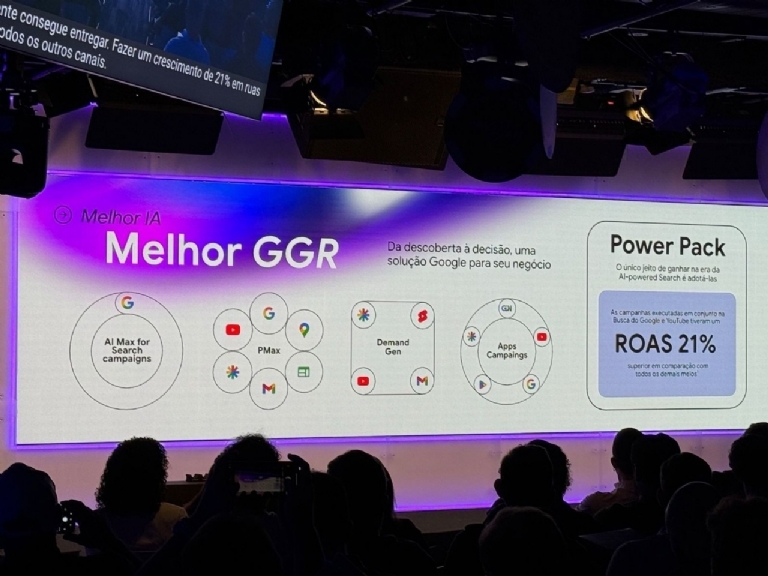

AI defines the next era of performance

A key focus of the event was demonstrating how artificial intelligence is reshaping acquisition strategies. AI-powered solutions, such as AI Max for Search and the Power Pack (Demand Gen, PMax, and App Campaigns), achieved ROAS 21% higher than the market average, reinforcing that advanced data usage will be fundamental for operational sustainability.

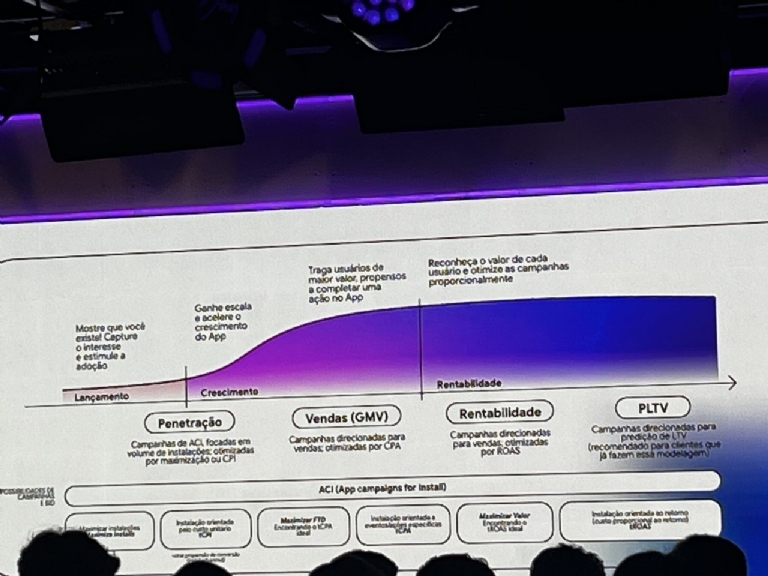

YouTube was highlighted as “the right arena for 2026,” especially for brands looking to differentiate and diversify their campaign formats. Apps were also emphasized as a priority channel to stimulate recurring use, increase lifetime value (LTV), and strengthen retention.

Networking and strategic exchange

Beyond numbers and panels, Bets Day provided a space for networking among professionals who are genuinely shaping the future of the sector. Every conversation brought new perspectives on technology, performance, and competition — essential components in one of Brazil’s most dynamic digital races.

Agenda offered insights through 2026

The program included:

* A 2026 outlook for the category and consumer, based on SimilarWeb data

* Brand growth strategies using YouTube

* The new era of AI-driven performance

* An executive panel on the future of iGaming in Brazil

Bets Day reinforced the perception that Brazil’s betting industry is at an inflection point.

With regulation, fierce competition, new technologies, and fast-changing user behavior, success will depend on brands’ ability to build reputation, operate intelligently, and fully leverage AI.

For many leaders in attendance, the event represented a turning point — and a preview of what will shape the sector in the coming years.

Source: GMB