Key insights:

- Brazilian players deposit less

Brazil’s average deposit amount reached US$142 in May 2025, reflecting a 5% year-over-year decrease, and standing nearly 50% below the global average of US$282. Over the trailing 12-month period, Brazil’s average was US$148, while global deposits remained relatively stable.

-Casino betting lags behind global benchmarks

In May 2025, global bettors averaged US$2,478 in monthly casino bets, while Brazil’s average stood at US$489. In terms of growth, global casino bettors rose 22% year-over-year, while Brazil’s growth reached 17%, recovering from a notable dip to 65% in January 2025.

- Sports betting volatile but recovering

Brazil’s average monthly sports betting amount in May 2025 was US$312, compared to US$466 globally. The number of Brazilian sports bettors showed a volatile trend, ending at 102% in May 2025 while the global growth ended at 99%.

- Brazilian players are more engaged

Brazil consistently outperformed global markets in user engagement. In May 2025, Brazilian players recorded 13.9 activity days per customer, nearly 86% higher than the global average of 7.5. days. The engagement gap widened sharply from January onward, reflecting increased platform stickiness and player loyalty.

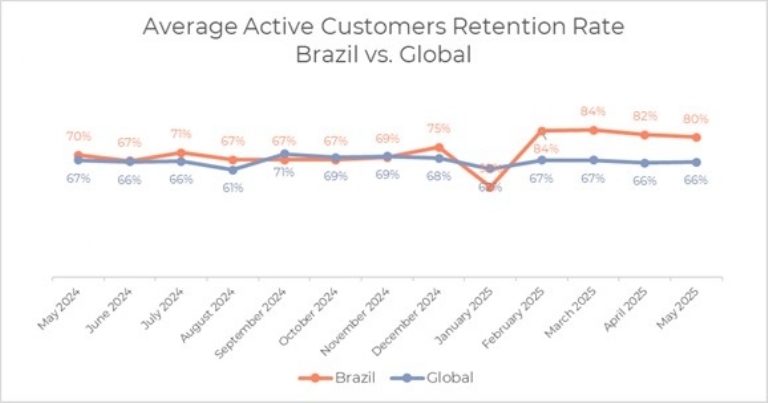

- Retention higher in Brazil since 2025

While retention rates were similar in 2024, Brazil began to outperform the global market from February 2025 onward. In May 2025, Brazil’s retention rate reached 80%, compared to a global average of 66%, which remained stable between 66–71% throughout the year.

Conclusion

While Brazil continues to trail global benchmarks in deposit levels and betting volumes, it has established itself as a standout in engagement and retention.

The rise in activity days and consistently higher retention rates point to a shift toward a more loyal, high-quality player base.

Going forward, opportunities in Brazil lie in leveraging this engaged audience through targeted monetization strategies, while narrowing the gap in player spend and betting volumes.

Report metrics

- Source: Betting trends in Brazil compared to the global benchmark in the trailing 12 months (May 2024-2025).

- Database: A 12-month average of over 5.5 million active players per month in Brazil and over 30 million globally.

Category: Average deposit amount

Key findings: Average Deposit Amounts is Lower in Brazil compared to the global average

In monthly average total deposit amounts, the global benchmark consistently outpaces

Brazil’s average by 90% on average.

Brazil’s average reached US$142 in May 2025 decreased by 5% compared to May 2024, while the 12-month average trailing to May 2025 stood at US$148.

Global deposit amounts remained relatively stable, reaching US$282 in May 2025, representing a 1% decrease in May year over year.

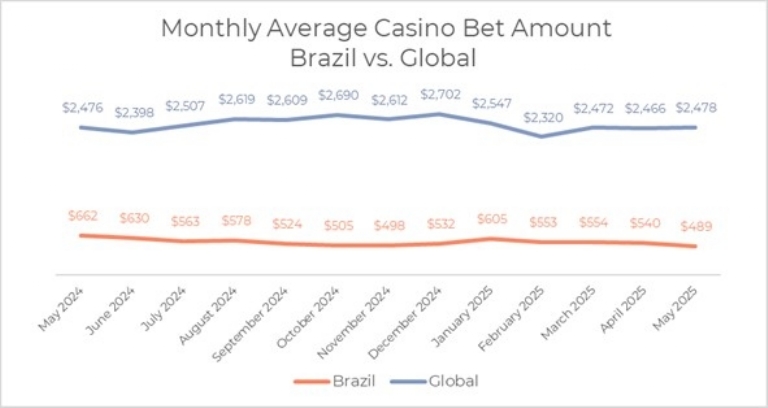

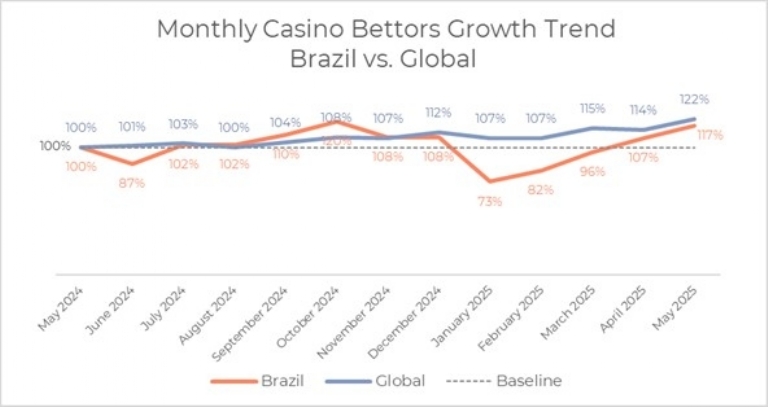

Category: Total monthly casino betting amount and number of casino bettors growth

Key findings: Global players lead in both average casino bet amount and growth of casino bettors compared to Brazil

Throughout the period, global bettors consistently outpaced Brazil in average monthly casino betting amounts, with a global average of US$2,478 in May 2025, compared to US$489 in Brazil.

In terms of casino bettor growth, the global market demonstrated steady and stronger performance, rising from a baseline of 100% in May 2024 to 122% in May 2025 (a 22% increase). Brazil, by contrast, showed a volatile trend. It experienced a significant dip in January 2025, followed by a recovery to 117% by May 2025, still trailing behind global growth.

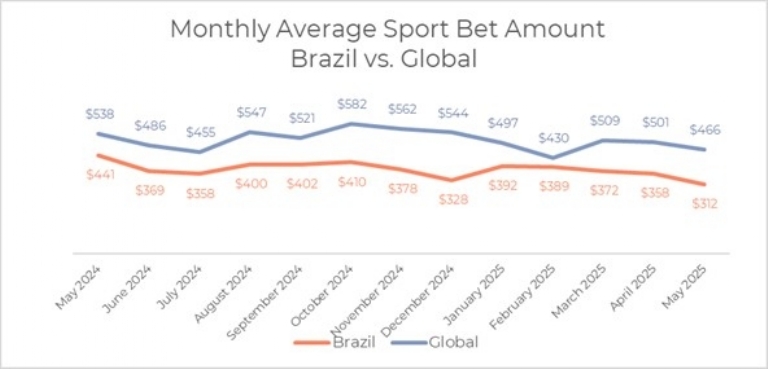

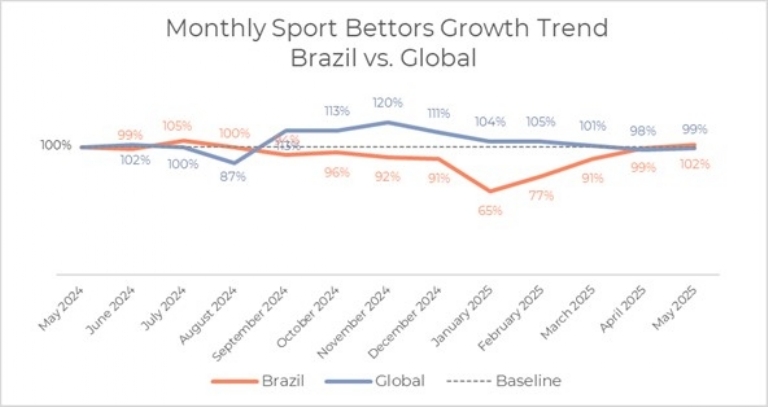

Category: Total monthly sports betting amount & number of sport bettors growth

Key findings: Global markets continue to lead in both average sports betting amount and bettor growth, while Brazil shows a gradual growth in number of sport bettors

Throughout the period, global bettors consistently outperformed Brazil in average monthly sports betting amounts, with a global average of US$466 in May 2025 compared to US$312 in Brazil.

In terms of sports bettors’ growth, the global market showed modest but consistent performance, rising slightly above the baseline throughout the year and ending at 99% in May 2025. Brazil, however, experienced a more volatile trend, peaking at 105% in July 2024 before declining to a low of 65% in January 2025. Despite this dip, Brazil recovered steadily in the following months, ending with a 2% growth above baseline (102%) in May 2025.

Category: Average number of activity days per active customer

Key findings: Brazil consistently maintained a higher engagement level than the global average, with the gap widening significantly in early 2025.

Unlike trends observed in other performance metrics, Brazil consistently outperformed the global market in average activity days per active customer throughout the period. The gap, which was modest early on, widened considerably following January 2025.

In May 2025, Brazil recorded 13.9 average activity days per customer nearly 86% higher than the global average of 7.5 days. This trend reflects a sharp rise in engagement in Brazil beginning in January, likely tied to shifting player behavior and regulatory impacts. In contrast, the global average remained stable with minimal variation over the 12- month period.

Category: Average active retention rate

Key findings: Brazil consistently outperformed the global market in terms of retention rate

While retention rates between Brazil and the global market were largely similar until January 2025, Brazil significantly outperformed the global average beginning in February 2025. In May 2025, Brazil’s retention rate stood at 80%, compared to the global average of 66%.

Source: Optimove