Higher taxation on betting sites has been mentioned by government members, BNDES president Aloizio Mercadante, and other economists as an alternative to a potential rollback of the IOF (Tax on Financial Operations) increase, which is under attack from Congress and the private sector.

Government data obtained by Folha via the Access to Information Law indicate that the average monthly revenue of betting sites is around R$ 2.16 billion (US$380m). This amount represents 7% of the total money spent by users on these platforms—this percentage is the industry standard, with the rest distributed as prizes, according to the platforms.

This revenue figure aligns with Central Bank data showing that Brazilians spend, on average, R$ 30 billion (US$5.25bn) per month on bets. Thus, to offset the R$ 20 billion (US$3.5bn) in IOF revenue, about R$ 1.67 billion (US$291m) per month would need to be collected from betting sites, which would represent 77% of their monthly revenue. Currently, these sites already pay 42% of their revenue in taxes.

"Taxing ‘Bets’ to compensate for the IOF is an economically unsound measure," stated the National Association of Games and Lotteries (ANJL) in a press release.

The increase in the tax on financial operations was proposed as a measure to help balance public accounts, but it faces resistance due to the resulting increase in credit costs for businesses.

On Monday last week (26), the president of the National Confederation of Industry (CNI), Ricardo Alban, suggested that the government tax betting sites and big techs instead of burdening the productive sector. However, the organization did not provide details on how such a plan would be implemented.

Under the current online betting law, those who bet online enjoy a tax advantage compared to players of traditional lotteries. The income tax on profits from online bets is 15%, compared to 30% for lottery winnings such as the Mega-Sena. The bill passed by Congress included a tax exemption for profits up to R$ 2,112, (US$369) but that section was vetoed by President Luiz Inácio Lula da Silva (PT).

In addition to standard service-sector taxes—ISS, PIS, Cofins, and corporate income tax—betting companies also pay a monthly regulatory fee to the Ministry of Finance’s Secretariat for Prizes and Betting (SPA) and allocate 12% of their revenue to the National Treasury to fulfill social obligations.

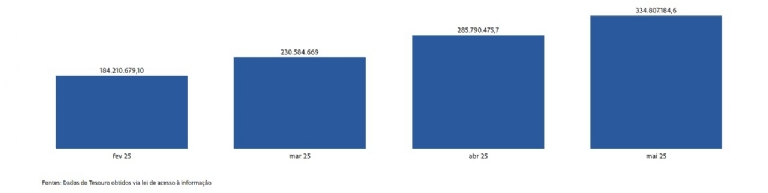

Requests for information made by Folha show that companies transferred, on average, R$ 259 million (US$46m) per month to the Treasury between February and May.

Destination of betting site revenues to the Treasury for social obligations

This amount is distributed among the Ministries of Health (1%), Education (10%), and Tourism (22.4%), Embratur (5.6%), the Ministry of Sports and other sports entities (36%), the Public Security sector (13.6%), and other funds and civil society groups.

The Ministry of Tourism, the biggest beneficiary, received between R$ 41 million (US$7.15m) in February and R$ 75 million (US$13m) in May, indicating that betting site revenues have been rising since the beginning of the year.

Amounts allocated by betting sites to the Ministry of Tourism

The monthly amounts collected by the regulator as oversight fees have also been increasing—from R$ 6.78 million (US$1.2m) in February to R$ 9.36 million (US$1.65m) in April. Since the fee amount is fixed, this trend indicates that both the revenue of the betting sites and the number of licensed companies have increased during this period.

ANJL supports the current revenue allocation model. "The model for allocating revenues collected from regulated betting is a reference for other countries, especially because of the efficient way the resources are allocated, which ultimately benefit the public interest."

In a statement, the IBJR (Brazilian Institute for Responsible Gaming) argued that betting companies "already face high taxation." Last year, industry entities lobbied Congress to avoid additional taxes, arguing that extra charges would favor illegal sites operating without licenses or tax payments.

The industry estimates that the illegal market receives over 50% of all betting spending in Brazil—meaning approximately R$ 30 billion more per year, over which there is no oversight.

"Fighting the illegal market can, in addition to increasing tax revenue, have a positive social impact by protecting bettors and reducing fraud and financial crimes," said IBJR.

Source: Folha