The six South American clubs — Palmeiras, Flamengo, Fluminense, Botafogo, River Plate, and Boca Juniors — are all sponsored by betting companies, along with Monterrey from Mexico, Porto from Portugal, and Inter Milan from Italy.

According to experts, betting companies are betting on global exposure to attract clients to a relatively new market, while injecting money and helping to boost financially stable clubs.

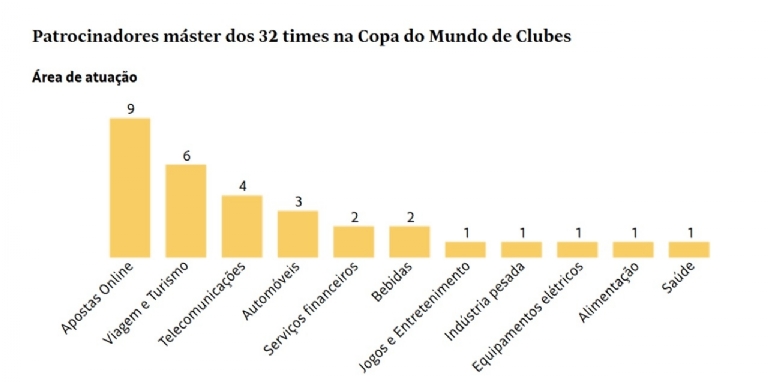

Travel and tourism companies come next, sponsoring six teams (18.8%), all European except Inter Miami, Lionel Messi’s team from the United States. Telecommunications (four), automobile (three), financial services (two), and beverages (two) follow among the top sponsors.

José Sarkis Arakelian, a consultant and professor at FAAP (Fundação Armando Alvares Penteado), stated that the online betting market is characterized by extremely low differentiation in products and services, which forces companies to look for market alternatives to capture customers’ attention.

“The user experience is always very similar. It’s an almost 'commoditized' service, and the consumer sees little differentiation in tangible aspects, which means companies have to focus heavily on the intangible — the brand concept, trust, and familiarity with the target audience.”

The image shows a scene from a football match between two players. One player is wearing a green shirt with white details and white shorts, while the other is in a blue and white shirt with blue shorts. Both are in motion, with one trying to dribble the ball while the other attempts to tackle. In the background, there are stands filled with fans and an electronic board displaying the name of the competition.

Arakelian added that in the case of major European clubs in the competition, such as PSG, Real Madrid, and Manchester City, the sponsors — Qatar Airways, Emirates, and Etihad Airways, respectively — are large Arab airline companies backed by their governments to boost visibility for their regions.

“These are different levels. At the top, you have what we call state-owned companies, which target the biggest global brands,” said the FAAP professor.

According to him, although Brazilian teams don’t have the same financial clout as Europe’s top-tier clubs, they are now on par with those in the continent’s second tier.

“As Brazilian clubs increase their revenue and offer higher salaries, they start to attract and retain more talent. Many players who, not long ago, would have moved to Europe are now staying in Brazil.”

After Flamengo’s 3–1 victory over Chelsea, the team’s coach Filipe Luís echoed a similar sentiment. “I believe there’s an elite in football, made up of around eight or ten clubs globally. And they are far superior. But beyond that elite, I think Brazilian clubs are on the same level as Europe’s second tier, especially due to how we compete, understand the game, and are used to playing on different pitches and altitudes.”

Estimates from the consultancy Convocados indicate that, driven by betting companies, the main sponsorship deals for the 20 Série A clubs could reach R$ 988 million in 2025 — a 70% increase compared to the previous year.

According to estimates by Alexandre Fonseca, CEO of Superbet, sponsor of Fluminense, the sector is expected to move around R$ 2 billion (US$361m) in sponsorship and advertising in sports in 2025, including major club deals, naming rights for tournaments and stadiums, media quotas, and presence on LED signs and boards.

“This cycle of financial and technical strengthening explains the performances on the field in the U.S., beating European favorites and showing that Brazil is once again competing on equal footing with the global elite,” said Fonseca.

Arakelian stressed that the money from betting companies helps form competitive squads and produce results on the field but emphasized that investment alone, without improvements in management and governance, is not enough.

An example cited is Corinthians, also sponsored by a betting company, but far from rival Palmeiras as a leading force in Brazilian football over the last decade.

“Financially healthy clubs use the capital to invest in their squads and generate results, while others use the money to cover past mistakes.”

Victor Bueno, partner and analyst at Nord Investimentos, added that even with one of the largest sponsorship deals in Brazilian football, Corinthians is in a “very delicate” situation. This is not just due to the size of its debt — which is nearing R$ 3 billion (US$542m) — but also the club’s ability to honor its commitments.

“Corinthians doesn’t have the ability to pay that debt either in the short or possibly even the long term. And if there’s no major financial management overhaul, the club is likely to end up in serious trouble,” said Bueno.

Ricardo Jacomassi, partner and chief economist at investment firm TCP Partners, said that rebuilding a club involves restructuring its financial, accounting, and asset management, and implementing professional boards of directors.

“All these changes have benefited some clubs, which have become role models for smaller teams in lower leagues. One such case is Bragantino, which, after being acquired by Red Bull, underwent an unprecedented transformation and became a benchmark for smaller clubs,” said Jacomassi.

Eduardo Corch, a sports marketing consultant and professor at Insper, stated that well-structured clubs have greater potential to attract strong sponsors, increase revenue, and create the conditions to invest in infrastructure — such as training centers and stadiums — as well as competitive squads.

“Of course, none of this guarantees immediate sporting success, but it greatly increases the probability of achieving good results. And when those results come, they create opportunities for participation in international tournaments, feeding back into the cycle with more visibility, prize money, and new commercial opportunities.”

Economist and partner at Convocados, Cesar Grafietti, cautioned that there is no single path for clubs to follow.

“Palmeiras and Flamengo have very balanced financial positions, high revenues, and controlled debt, while Botafogo is a SAF (Sociedade Anônima do Futebol) with little transparency, part of a multi-club network whose French asset is struggling, and no one really knows the financial status,” said Grafietti.

As for Fluminense, the team largely survives on occasional income like prize money and player transfers, but deals with high debt.

“In the end, we have three business models, which only shows that on-field performance is often just a reflection of good squad management. And for that, there’s no fixed formula: clubs may have high revenues, shareholder investments, or spend and go into debt.”

Source: Folha