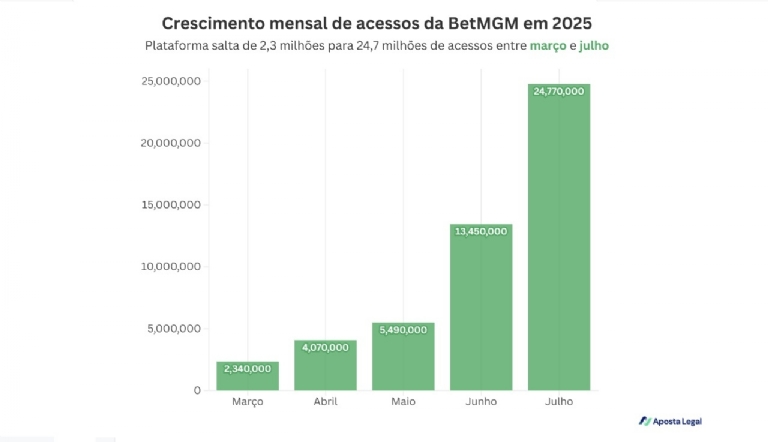

In Brazil’s highly competitive market, the strategic use of free-to-air television has become a key differentiator. In July alone, BetMGM saw an impressive 84% increase in traffic, making it the fastest-growing platform in the country during that period. Despite being new to the scene, the site already ranks among the top 20 most accessed in Brazil.

The new platform, headquartered in São Paulo, is expected to go fully live in early 2025, following the anticipated licensing from the Ministry of Finance (SPA) later this year.

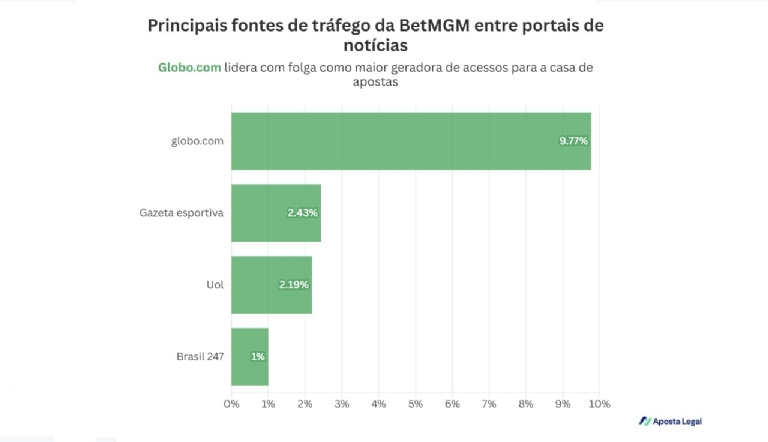

Much of this performance is attributed to Grupo Globo’s strength as a distribution channel. Aposta Legal data shows that roughly 10% of BetMGM’s traffic originates from Globo.com, currently the seventh most visited site in the country.

Multiplatform presence and integration with Globo products

Grupo Globo’s strategy includes TV and online advertising campaigns, along with integration of BetMGM into popular products such as Cartola FC, reinforcing its connection with the sports audience. The brand has also been promoted during prime-time programming, with prominent figures like Luciano Huck acting as brand ambassadors.

Global impact and expansion plans

BetMGM’s entry into Brazil is already impacting the company’s global performance. The joint venture between MGM and Entain has raised its global revenue forecast to USD 2.6 billion in 2025, with an expected operating profit of USD 100 million. The company’s CEO highlighted the “strength of the Globo partnership” as one of the key drivers behind this growth.

In Q1 2025, BetMGM recorded a 27% increase in total revenue and a 68% jump in sports betting operations.

BandBet takes a different pace

Direct competitor BandBet is also relying on free-to-air TV to grow, but with more modest results. In July, the site received 2.99 million visits, with 25% of that traffic coming from Band.com. The brand is promoted through shows like the comedy ‘Perrengue na Band’ and via segments during the network’s newscasts, such as ‘Jornal da Noite’.

Despite a slower pace, BandBet — which operates with a federal license and OpenBet technology — is betting on Band’s journalistic credibility, a stable platform, PIX integration, and a locally focused portfolio to establish itself long term.

Clash of media giants

While BetMGM already employs more than 200 people in Brazil and plans to double that number by year’s end, offering bets on 28 sports, live streaming, cash out, and bet builders, BandBet is taking a more cautious but steady approach.

The battle between betting platforms backed by major TV networks is just beginning, but BetMGM has taken the lead with Grupo Globo’s support — ensuring greater visibility and the potential for faster growth in Brazil’s booming market, which is estimated at USD 3 billion with annual double-digit expansion.

Source: Aposta Legal