Globally, the company beat Wall Street estimates, delivering solid performance in both iGaming and the U.S. market. The world leader in online sports betting and iGaming operations reported adjusted earnings per share of US$2.95, above the US$2.11 forecast by analysts. Global revenue reached US$4.19 billion, a 16% increase over the prior year and ahead of the US$4.08 billion estimate.

Adjusted EBITDA rose 25% to US$919 million, with a margin of 21.9%, up 150 basis points. Despite the solid results, company shares fell 0.6% after the announcement.

In the United States, Flutter continued to show strength, with revenue up 17% to US$1.79 billion and adjusted EBITDA rising 54% to US$400 million. The segment margin increased 530 basis points to 22.3%, reflecting scale gains and operational efficiency. iGaming was a standout performer, growing 42% in the U.S. and 27% in international markets.

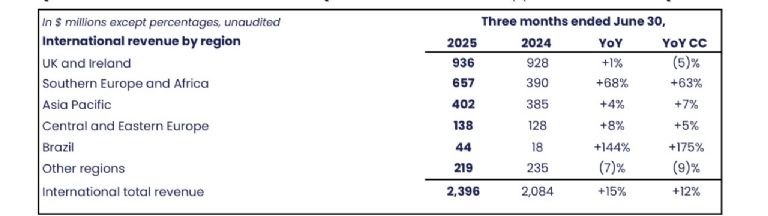

In Brazil, quarterly revenue surged 144% (+175% in constant currency), with the NSX acquisition contributing 185 basis points to this growth. Conversely, Betfair Brazil saw a drop in revenue due to unfavorable sports outcomes and the impact of customer re-registration friction following regulation. Adjusted EBITDA margin stood at 24.7%, down 40 basis points, attributed to the investment phase in the country.

Flutter CEO Peter Jackson highlighted that the Q2 performance reflected organic growth combined with strategic acquisitions: “I am pleased with the excellent underlying performance we delivered in the second quarter, alongside good progress made on a number of important strategic initiatives. Revenue grew 16% year-on-year as we continue to build scaled positions in the most attractive markets through strong organic growth and value-creating M&A.”

He also emphasized the importance of recent acquisitions: “In our International markets, the completion of the Snai and NSX transactions in the quarter created a leadership position in Italy for Flutter and established a scaled position in the newly regulated Brazilian market. Both acquisitions are driven by a clear strategic rationale to expand our presence in attractive, regulated markets, leveraging the Flutter Edge to drive operational and product improvements.”

Regarding Brazil, Jackson indicated that integrating local operations is a priority: “Following the combination of NSX and Betfair Brazil, creating Flutter Brazil, our immediate focus has been on equipping our newest region with the best talent from across Flutter.”

“The Brazilian market remains highly competitive and we retain strong conviction that large-scale operators with the best products will secure the largest market share. In that regard, our strategy is to elevate our Brazilian proposition, leveraging the Flutter Edge to deliver a unit economics model that we can invest in and scale meaningfully.”

The CEO also pointed to immediate actions and short-term targets: “We are pursuing quick wins in product and marketing, where immediate improvements have already been made to iGaming content, generosity capabilities, and digital marketing effectiveness, while our sports product roadmap will deliver significant enhancements to the customer proposition over the next twelve months.”

Flutter has revised its 2025 guidance upward, now expecting revenue of US$17.26 billion and adjusted EBITDA of US$3.295 billion, representing annual growth of 23% and 40%, respectively.

Source: GMB