In partnership with Offerwise, the online quantitative study “Sales Excellence Insights | 'Bets' 2025 Research: the sports betting market in Brazil” was conducted last May, targeting Brazilian men and women over 18 years old. The sample consisted of 1,000 interviews (59% bettors and 41% non-bettors) and is divided into 5 sections:

1. The Brazilian bettor and their journey

2. Responsible Gaming

3. The non-bettor

4. Brands vs. Media

5. Globo's vision for brands

Grupo Globo's objective was to understand the current scenario of the sports betting market in Brazil after regulation, identifying opportunities and challenges for brands facing both betting and non-betting audiences, in addition to mapping their relationships with different media outlets.

The "Globo Betting Insights" event was closed only to account executives, heads of marketing, and directors of bookmakers that advertise with Grupo Globo solutions, as well as agencies, industry representatives, and special guests. to the gaming industry in Brazil.

Companies present included: Alfabet, Ampfy, Aposta Ganha, Bet da Sorte, Bet.Bet, Bet365, Betano, Betfast, Betfair, Betnacional, Betsson, Betsul, Betvip, Casa de Apostas, Clever, Donald Bet, Esporte da Sorte, EstrelaBet, H2Bet, Hiberbet, KTO, IBJR, Lovely, MMABet, Novibet, Pixbet, PlayUzo, Rivalo, Sportingbet, Stake, Superbet, and Vbet.

In addition to presenting the audience survey, the meeting also addressed concepts on sensitive topics such as responsible gaming and promoted the exchange of experiences among industry professionals. The event demonstrated that the market is maturing, but also reinforced the importance of responsibility, transparency, and a safe experience for players.

Some of the main survey results

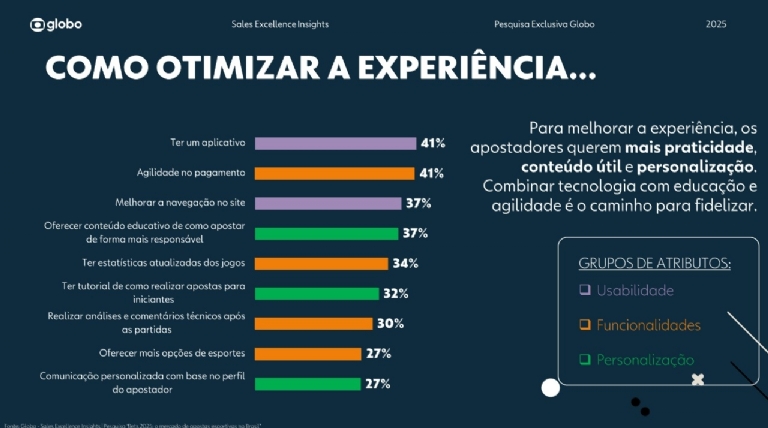

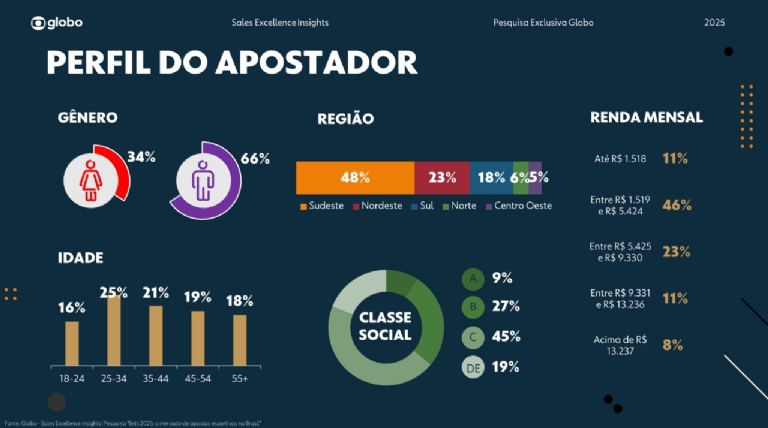

Bettor profile in Brazil

Regions:

-Southeast (48%)

-Northeast (23%)

-South (18%)

-North (6%)

-Midwest (6%)

Social class:

-A (9%)

-B (27%)

-C (45%)

-D/E (19%)

Bettor profile:

-Conservative (45%)

-Moderate (49%)

-Engaged (6%)

Bettors' perception of sports betting:

-Entertainment (51%)

-Gambling (19%)

-Sports (10%)

-Source of Supplemental Income (10%)

-Way to Invest Money (9%)

Reinforcing the recreational nature of betting is essential. There is room for education about the risks and limits, in addition to promoting more transparent and conscious practices.

Motivation for betting

-For fun (72%)

-To supplement monthly income or investments (38%)

-To stay connected or socialize with friends (19%)

-To follow the sports they enjoy (18%)

-To test their knowledge about sports in general (13%)

-It's the main source of income (12%)

Most continue to bet for leisure. Income still appears as a motivation for a significant portion, but social connection and passion for sports are also relevant factors in betting behavior.

Betting frequency

-Heavy Users (daily or up to 5 times a week) (2025: 32%) (2024: 22%)

-Medium Users (1 to 3 times a week) (2025: 51%) (2024: 55%)

-Light Users (1 to 3 times a month or less) (2025: 17%) (2024: 23%)

The frequency of consumption increases after the decline seen last year. With the implementation of regulations, bettors are more confident.

Monthly invested in sports betting

-Up to R$100 (US$18.5) (63%)

-From R$101 to R$500 (US$18.5 to US$92.5) (26%)

-Between R$501 and R$1,000 (US$92.5 and US$185) (7%)

-Over R$1,001 (4%) (US$185)

Predominant profile of low-risk bettors investing up to R$100 (US$18.5). Slight growth in investment ranges over R$501 (US$92.75)

Preferences – Bet types

-Single bet (58%)

-Multiple bet (34%)

-Double Chance (30%)

-Live (27%)

-Custom bet (BetBuilder) (17%)

* Mobile is the most used tool for betting

* Pix is the preferred transfer method:

For deposits (78%)

To withdraw winnings (85%)

Preferences – market types

-Typically diversify the types of markets they bet on (76%)

-Decide based on the odds (12%)

-Bet only on the team they support (8%)

-Unsure of the market type (4%)

Winning Team (45%)

Match Result (42%)

First to Score (20%)

Yellow/Red Cards (18%)

Corners (18%)

Next to Score (during the game) (16%)

The bettor's journey

Attributes considered relevant for online sports betting

1. Brand Reliability

2. Secure Environment

3. Payment Speed

Reasons for opening an account with an online sportsbook

-52% TV Advertising

-47% License in Brazil

-42% Experience from Friends

-41% Positive Reviews from Specialized Websites

Advertising is a powerful ally in the brand-building process. Bettors also value authorized companies, as they choose based on security, trust, and good experiences.

Factors that influence the choice of a betting brand

-Speed in paying out winnings (59%)

-Have different betting payment methods (57%)

-Brand credibility (57%)

-Being approved by the Federal Government (51%)

-Better odds on game odds (46%)

-Platform being more intuitive and easy to navigate (44%)

-Having a variety of international championships (42%)

-Seeing that the brand is on TV (29%)

How you choose which sports to bet on

-Sports you like to watch (43%)

-Sports you know deeply (36%)

-Based on odds and winning chances, regardless of the sport (29%)

-Sport with the best odds (25%)

-Sports you practice (24%)

Sports you usually bet on

-Men's football (76%)

-Women's football (31%)

-Basketball (23%)

-Volleyball (19%)

-Poker (17%)

-MMA (15%)

Football tournaments they bet on the most

-Brazilian Championship (77%)

-Copa do Brasil (61%)

-Copa Libertadores (45%)

-Champions League (40%)

-FIFA World Cup (38%)

-Copa America (34%)

-CONMEBOL Sudamericana (33%)

Despite the preference for national competitions, continental tournaments had high participation, possibly because they involved Brazilian teams in the competition.

Search for content to place bets

-Sports programs on TV (44%)

-Sports websites (e.g., GE/Globoesporte, etc.) (39%)

-Sports programs on the Internet (38%)

-Social media groups (32%)

-Influenced by friends (29%)

Other types of bets placed

-Federal Lottery (58%)

-Crash game/Online games (45%) (52% are heavy users – they usually play daily or up to 5 times a week / 62% usually play at night – between 6 PM and midnight)

1. Fortune Tiger (77%)

2. Aviator (46%)

3. Gates of Olympus (35%)

4. Crash hit (32%)

5. Mines (31%)

-Online casino (38%) (50% are medium users – 1 to 3 times a week / 70% (They usually play at night - between 6 p.m. and midnight)

1. Roulette (64%)

2. Slots (61%)

3. Poker (55%)

4. Blackjack (40%)

5. Live games with a live dealer (34%)

-eSports (28%)

-Jogo do Bicho (25%)

Responsible Gaming

With the regulation of sports betting in Brazil, expectations for a safer, more transparent, and responsible market are growing, and bettors recognize the importance of regulation to promote good practices in the sector.

-79% believe that regulation will bring greater security to players

-76% believe that with regulation, only trustworthy companies should continue operating in Brazil

-72% feel more motivated to bet now that they know the activity is legal

-78% of bettors believe it is very important to talk about the negative effects of gambling and the risk of addiction

6 in 10 bettors recognize that sports betting can have a negative impact on the financial health of Brazilians and are therefore monitoring their own behavior:

-85% have already stopped betting when they notice losses

-83% try to set limits on the frequency with which they bet

-83% try to limit the monthly amount used to bet

-61% admit to having bet to try to recover losses – Risky behavior

Source: Exclusive GMB