According to Vieira, the increase in taxes on the regulated market will force operators to lower their “odds” in order to offset tax expenses. In the betting world, the term refers to the chances of an event taking place. The higher the odds, the more money platforms pay out on a given bet.

The reduction in odds, Vieira argued, will drive players to seek more profitable betting opportunities on illegal platforms that are not subject to regulation or taxation. With fewer users in the legal market, company profits will fall, which in turn will reduce federal tax revenues from the sector.

“By raising taxes, you end up giving a gift to illegality. Odds are like the price of a product. When prices go up in the regulated market, you encourage people to look for more attractive bets in the illegal market,” Fernando Vieira said.

The president of IBJR cited what happened in the Netherlands following a tax hike on betting. The European country raised the sector’s rate from 30.2% to 34.2% in January 2025 and is preparing a new increase to 37.8% in January 2026.

Data collected by VNLOK (Licensed Dutch Online Gambling Providers), an association of Dutch licensed platforms, show that the sector’s gross revenue fell 25% in the first half compared with the same period last year.

Meanwhile, the KSA (Kansspelautoriteit), the country’s gambling regulator, projects that higher taxes on the regulated market will result in a €200 million revenue loss in 2025.

Illegal market holds up to 51% of bets

A study by LCA Consulting, conducted in partnership with IBJR, estimates that the illegal market represents between 41% and 51% of the betting sector in Brazil.

According to the study, the annualized revenues of unregulated operators total between R$26 billion (US$4.8bn) and R$40 billion (US$7.35bn). In terms of tax collection, this translates into a loss of R$7.2 billion (US$1.35bn) to R$10.8 billion (US$2bn) per year for the regulated market.

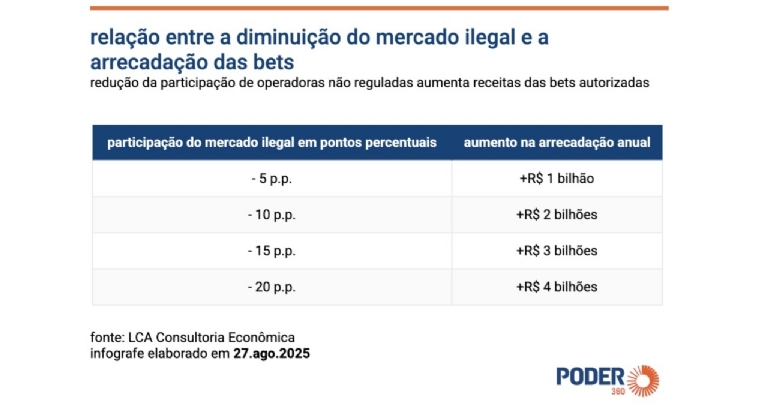

LCA states that there is an inverse relationship between the size of the illegal market and overall tax collection. The consultancy calculates that every 5 percentage-point reduction in the share of unregulated betting corresponds to an average increase of R$1 billion (US$184m) in the legal market’s annual revenue.

The IBJR president explained that the opposite also applies. According to him, the expansion of the illegal market due to higher taxation on betting could have an impact of up to R$2 billion (US$368m) annually on the sector’s revenues. His projection is that the tax hike will increase the share of unregulated operators by 10 percentage points.

“The betting sector could lose as much as R$2 billion per year. If the illegal market grows by 5 percentage points, tax revenues fall by R$1 billion. That’s roughly the estimate,” Vieira said.

The betting sector ceased being illegal in Brazil in 2018 but only began operating under regulatory rules in January 2025. Currently, 78 companies are authorized by the Ministry of Finance, and 182 brands are operating within government parameters.

The Provisional Measure that raises taxation on betting was issued by the Lula government as an alternative to the decree that increased the Financial Transaction Tax (IOF). The measure also changes rules for the taxation of financial investments and virtual assets. It is currently under review by a joint congressional committee. It must be approved by the committee, the House, and the Senate by October 8, when it will expire.

Source: Poder360