The Sumsub study analyzes the period between 2023 and the first quarter of 2025, with relevant data on comparative metrics from 2023 to 2024 and analytical insights from Q1 2025.

One of the publication's highlights is the alarming growth in the use of artificial intelligence for document forgery, an attack category that affected 78% of iGaming companies worldwide.

Another point of concern is the shift in the timing of fraud: onboarding, previously the focus of attention, now accounts for 23.8% of cases and is second only to deposits, with 41.9% of incidents. Withdrawals (22.9%) and gaming activities (11.4%) round out this ranking.

Identity fraud continues to lead the statistics, accounting for 64.8% of cases – most of which were recorded between 4:00 AM and 8:00 AM, while compliance teams had not yet started their daily work, and outside the peak hours for legitimate users, around 6:00 PM.

The insights from Sumsub's report, obtained from internal data and industry research, highlight the need for comprehensive, automated systems that monitor attempts to circumvent existing defenses.

Fraudsters keep an eye on regulations

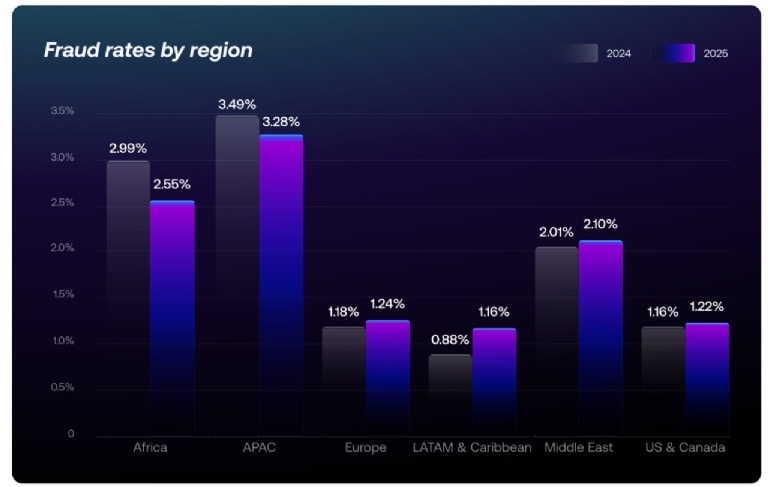

The number of frauds reported by iGaming operators is alarming, but still represents a small fraction of the market. As mentioned, Latin America saw the largest increase in cybercrime in 2024, but the attack rate corresponds to 1.16% of all reported cases, up from 0.88% in 2023.

The overall numbers are lower than those recorded in countries like Europe (5.1%), North America (5.2%), and Africa (where there was a 14.7% reduction, although the disproportionate growth is noteworthy).

The survey by Sumsub, one of the report's main data sources, also asked companies in the sector about the biggest risks they face in the current scenario, with identity fraud (64.8%), money laundering (64.8%), and bonus abuse (63.8%) virtually tied. Payment fraud (31.4%) and account takeovers (23.8%) round out the ranking.

Globally, more than 78% of iGaming operators have seen an increase in the use of AI by cybercriminals; of these, 34.3% consider the increase notable enough to attract attention as a new trend for the sector. The report also highlights an alarming increase in deepfake rates.

Brazil is a focal point in this regard, as such frauds are five times more frequent than in the US and 10 times higher than in Germany. The dynamics are also impressive: last year, the rate of deepfake fraud in Brazil soared 822%.

"The increase coincides with Brazil's regulatory transition, highlighting how fraud attempts are intensifying as operators adapt to government requirements," explains Kris Galloway, Head of iGaming Products at Sumsub. "This movement means that new tactics are becoming commonplace in the arsenal of cybercriminals, who are organizing themselves into sophisticated networks to exploit vulnerabilities in platforms."

Agile verification, but without forgetting compliance and security

Besides fraud, compliance remains a key focus. Nearly a third (29.5%) of global operators state that complying with new regulations is "very challenging," especially as stricter rules related to money laundering, age verification, and data management are applied.

Brazil is a prime example of this, having gone from being a "gray market" in 2024 to a highly regulated sector in January of this year. The new rules involve mandatory biometrics for onboarding, ISO 27001 security certifications for verification service providers, and penalties that can reach R$2 billion for companies that fail to comply.

The country is a leading global example of complex regulatory systems, although the market is also considered ‘Bets’ friendly.

As regulations become stricter and fraud becomes more sophisticated, agility becomes a key differentiator. The average verification time across the industry has decreased from 32 seconds in 2023 to just 25 seconds in 2025. This speed translates into improved player conversion and retention.

Recently launched solutions are helping to simplify the onboarding process. Document-less verification enables identity verification without uploading physical documents. Reusable digital identity (KYC) allows returning users to skip repeated verifications, while Sumsub ID is a portable digital identity that can be reused across different platforms.

Operators using the document-less method reported a 53% reduction in processing time and 35% more customers successfully onboarded. Reusable KYC solutions helped cut verification time for returning users in half, while Sumsub ID increased approval rates by 30%.

"Speed and flexibility are key to continuing to win in increasingly complex markets, where compliance demands and fraud sophistication are only increasing. New solutions are giving operators a significant advantage, not only in combating cybercriminals but also in agility in onboarding legitimate customers," adds Galloway.

Methodology

The report's content is based on detailed statistics and analysis of current fraud incidents (all internal data has been aggregated and anonymized). iGaming and identity fraud experts from Sumsub and partner companies also share their industry predictions, highlighting complex challenges related to different fraud schemes and practical measures needed to prevent them and protect businesses.

Sumsub is a full-cycle verification and continuous monitoring platform that protects the entire user journey. With customizable KYC (Know Your Customer), KYB (Know Your Business), Transaction Monitoring, Fraud Prevention, and Travel Rule solutions, Sumsub enables you to orchestrate the verification process, expand your global customer reach, meet compliance requirements, reduce costs, and protect your business.

The company serves over 4,000 clients in sectors such as fintech, cryptocurrency, transportation, trading, edtech, e-commerce, and gaming, including Duolingo, Bitpanda, Wirex, Avis, Bybit, Vodafone, Kaizen Gaming, and TransferGo.

Source: Sumsub