The main challenge is that this monitoring is constantly undermined by digital disguise methods such as VPNs, proxies, GPS spoofing, emulators, and practices like location jump (abrupt and incoherent change of location).

When undetected, these attempts put the operation at risk of regulatory violations, fines, license suspension, and high-impact financial losses.

Moreover, masked access is directly linked to the worst indicators of retention, engagement, and LTV.

To prevent this, forensic geolocation solutions come into play, integrating multiple signal sources and applying machine learning to detect inconsistencies in real time.

The system must operate invisibly to the user, validating locations with high accuracy and low friction by design, with additional steps only when risk is detected.

The importance of forensic geolocation

Ministerial Ordinance MF/SPA No. 722/2024 requires precise verification of users’ geographic location during their activities.

It aims to prevent fraud, money laundering, and tax evasion. However, if the verification is not robust enough, your operation could face serious risks such as fines, license suspension, and financial damage.

In addition, digital fraud has a direct impact on LTV, affecting revenue, retention, and new user acquisition.

How fraud can bypass standard geolocation

Fraudsters use various tactics to hide their real location and mask fraudulent actions.

Methods such as VPNs, GPS spoofing, emulators, location jump (abrupt change of location), and multi-accounting (use of multiple accounts) can be difficult to detect with a standard geolocation solution.

These loopholes create significant vulnerabilities, allowing fraudsters to access the platform undetected, compromising operational integrity.

Advanced geolocation: how it works in practice

Advanced geolocation integrates multiple signal sources—IP, GPS, Wi-Fi, cell towers (LBS), and device data—while applying machine learning to detect inconsistencies in real time.

The system performs automatic re-checks every 30 minutes, ensuring continuous location validation.

This process is low friction by design, meaning the user experience remains uninterrupted unless risk is detected. When this happens, additional verification steps are triggered.

Integration & SLO: how implementation works

Integrating forensic geolocation into your platform is straightforward, with options such as SDKs and webhooks that allow monitoring and correlating events in real time.

Examples of monitored events include location checks during registration, login, deposits, withdrawals, and data changes.

This continuous integration ensures the operation remains compliant while optimizing the user experience without interruptions.

LGPD & governance: protecting personal data

Compliance with the LGPD (General Data Protection Law) is essential. Forensic geolocation collects data only with explicit consent and ensures that data is minimized and protected against leaks.

In addition, geolocation solutions provide audit trails to guarantee full transparency and compliance with legislation.

And how does this impact a business’s LTV?

Efficient location verification not only helps prevent fraud but also has a significant impact on a user’s LTV. By ensuring your player base is genuine, you increase retention and ARPU (Average Revenue per User). Here’s how it works in practice:

Scenario 1: Genuine player base (with forensic geolocation filter)

* Average CPA: R$ 200

* ARPU: R$ 600/month

* Average retention: 8 months

* Genuine LTV = (R$ 600 × 8) – R$ 200 = R$ 4,600

* Total campaign LTV (100,000 players) = R$ 460,000,000

Scenario 2: fraud-contaminated base (without forensic filter)

* Average CPA: R$ 200 (same investment)

* ARPU: R$ 0 (or negative due to bonus abuse)

* Average retention: 1 week (fraudster’s lifecycle)

* Fraudulent LTV = (R$ 0 × 0) – R$ 200 = –R$ 200

* Fraud impact at 5%:

- 5,000 fraudulent players

- Total loss = R$ 1,000,000

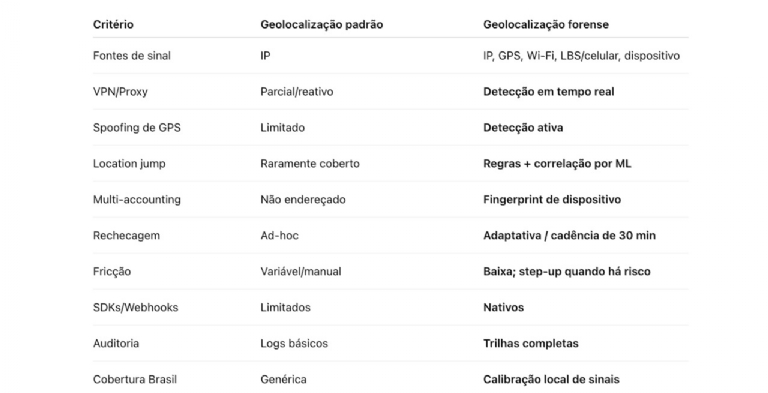

Comparison: standard vs. forensic geolocation

At the end of the day, forensic geolocation is not just about meeting one more ordinance. It represents the dividing line between two business approaches. On one side, operations that aim only for the bare minimum, left vulnerable to risks that erode profitability and reputation. On the other, operations that see security as a growth pillar.

The choice of verification technology today defines your business’s financial health tomorrow. Here, the issue goes beyond compliance and raises the question: is your operation truly shielded against threats that can erode profitability?

Request a risk assessment and see firsthand the impact on your LTV!

Source: Legitimuz