For betting operators processing millions in transactions daily, the choice of certified technology providers can mean the difference between a profitable operation and multi-million-dollar losses from a single incident.

When iGaming technology providers hold ISO/IEC 27001:2022 certification, they implement controls that drastically reduce risks, creating a protective barrier that shields operators and customers from many vulnerabilities responsible for major financial damages in the sector.

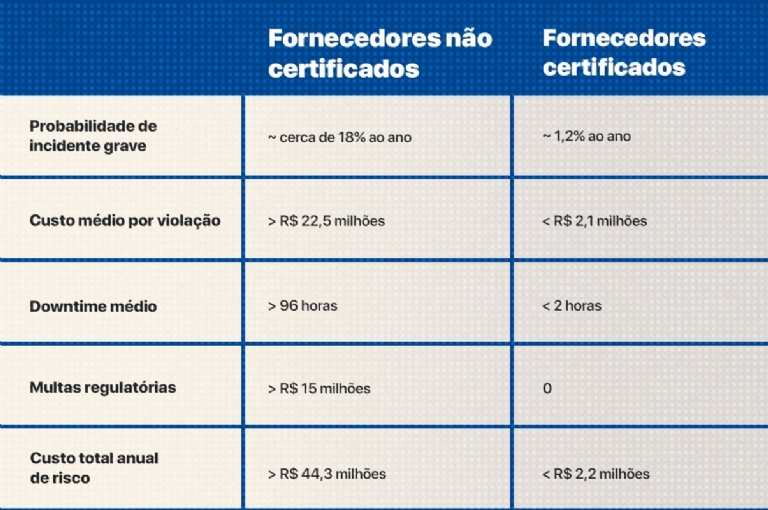

The real cost of insecurity for betting operators

According to studies, a single security breach costs an average of US$ 4.35 million. For betting platforms, this figure is amplified by the critical nature of their operations: 24/7 payment processing, real-time identity verification, proprietary odds algorithms, and a complete betting history subject to regulatory audits.

Total losses = regulatory fines + license revocations + customer churn + remediation costs + operational downtime

In practice:

How ISO 27001 strengthens data protection

ISO 27001-certified KYC providers raise the security standards for betting operators by applying robust measures at every stage of the process.

This is because the standard ensures the implementation of controls aligned with the CIA triad (Confidentiality, Integrity, Availability), globally recognized as the foundation of information security:

* Confidentiality: KYC/AML data protected through access controls, encryption, and confidentiality policies.

* Integrity: Immutable betting histories via hashing, biometric validation with 99.2% accuracy, and auditable transactional consistency.

* Availability: 99.9% uptime guaranteed, RTO under 4 hours, and 24/7 operational continuity.

Attack vectors neutralized

In addition to the CIA triad, ISO 27001-certified providers are able to block the most common cyberattacks that devastate betting operators:

* DDoS attacks: mitigated through CDN and intelligent throttling.

* Account Takeover: biometric prevention reducing attacks by up to 99.7%.

* Payment Fraud: machine learning blocking millions of fraudulent attempts monthly.

Automatic multi-jurisdictional compliance

Thanks to standardized ISO 27001 processes, operators can achieve automatic compliance across multiple jurisdictions, reducing both legal and operational risks:

* LGPD (Brazil)

* GDPR (Europe)

Protected KYC: superior performance

Operators working with certified providers achieve consistent results—faster, safer, and more cost-efficient processes. The impact is direct on KYC performance, generating average operational and financial gains such as:

* KYC conversion rate: 85% vs. <70% (industry average)

* Verification time: <30 seconds vs. ~4.2 minutes

* Chargeback reduction: up to 94%

Proactive detection with certified AI

An ISO 27001-certified provider can incorporate AI in a structured way to anticipate risks and block fraud before losses occur.

Examples include:

* Behavioral analytics: detection of anomalous patterns with 99.4% accuracy.

* Dynamic risk scoring: automatic blocking of suspicious transactions.

* Fraud prevention: average loss prevention of R$ 3.2 million per month.

Shielding against supply chain attacks

With the 2022 revision, ISO 27001 now requires specific controls against supply chain attacks. This enables betting operators working with certified providers to significantly reduce third-party incident risks, achieving higher operational security compared to industry averages.

Continuous audit: the protective PDCA cycle

Certification also establishes a continuous protection cycle, ensuring security is constantly updated and validated.

Processes include:

* Internal audits: semiannual, proactively identifying vulnerabilities.

* Risk analysis: quarterly, with constant control adjustments.

* Penetration testing: monthly, ensuring resilience.

* 24/7 monitoring: SOC with average 15-minute response time.

Protected business intelligence

Beyond operational gains, certified providers secure the most strategic assets for betting operators’ competitiveness, including:

* Odds algorithms: shielded from industrial espionage.

* Performance metrics: dashboards with restricted and controlled access.

The strategic imperative: is your operation protected?

According to IT Governance, working with suppliers that maintain a mature ISMS significantly reduces both the likelihood and impact of breaches. ISMS.online also highlights that partnering with ISO 27001-certified providers helps betting operators stand out with regulators.

By taking this route, operators avoid multi-million-dollar losses and build a solid, long-term competitive advantage. In the end, the real question is not whether it’s worth investing in certified providers—but whether operators can afford not to.

Test the difference!

Schedule a free technical demonstration of KYC with ISO 27001 controls vs. your current solution.

Notes:

1. Cost of breach and operational risk:

The average cost of a data breach is estimated at US$ 4.35M (IT Governance). Organizations with a mature ISMS (e.g., ISO 27001) show lower likelihood of severe incidents, reduced downtime, and lower financial/regulatory costs (ISMS, IBM). Figures are estimates and subject to variation.

2. Data protection, CIA triad, and attack vectors:

Examples of protection, precision, uptime, RTO, and mitigation (Account Takeover, DDoS, Payment Fraud) are based on Legitimuz practices.

ISO 27001 ensures implementation of security controls but does not guarantee all providers achieve these exact indicators.

3. KYC performance and process protection:

KYC performance, proactive AI detection, fraud prevention, supply chain shielding, and audit cycles are based on Legitimuz practices. ISO 27001 certification ensures the implementation of security controls, but does not guarantee that all suppliers will achieve these specific indicators in all operations.

Source: Legitimuz