Key insights:

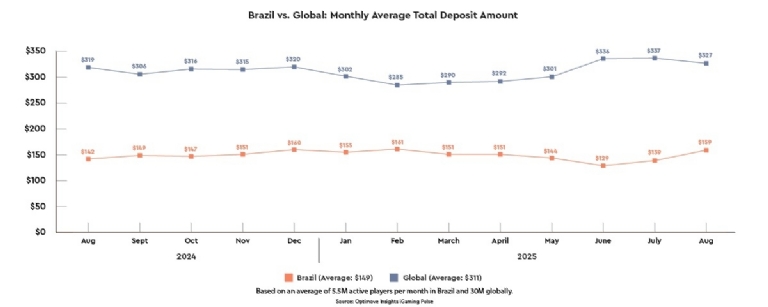

* Brazilian players deposit less but show upward trend: Brazil's average deposit in August 2025 was $159, significantly lower than the global average of $327. This represents a 12% year-over-year (YoY) increase for Brazil (from $142 in August 2024), compared to a 3% increase globally (from $319).

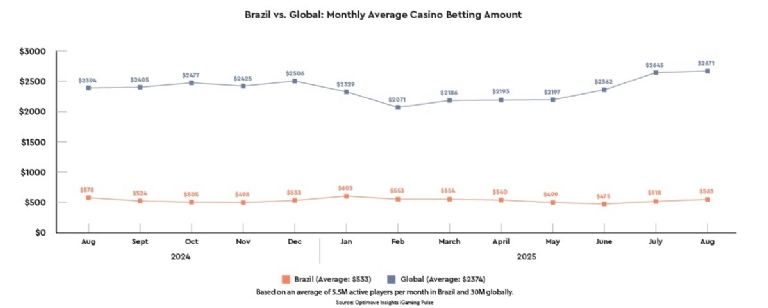

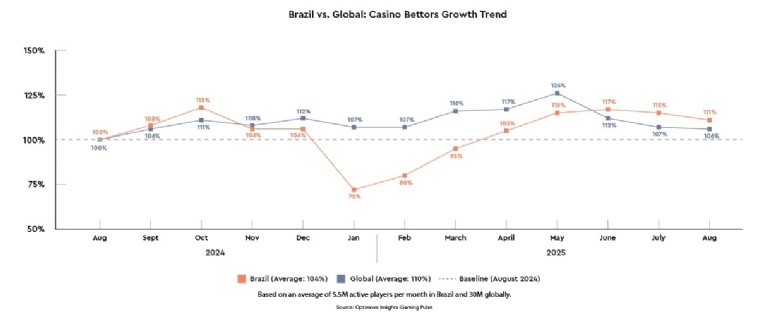

* Casino betting lags behind global benchmarks: Brazil lags in total casino betting volume ($550 vs. $2,671 globally in August). Year-over-year, Brazil saw a 5% decline (from $578), whereas the global average grew by 12%. Still, Brazil maintained strong casino bettor growth, outpacing the global trend in recent months.

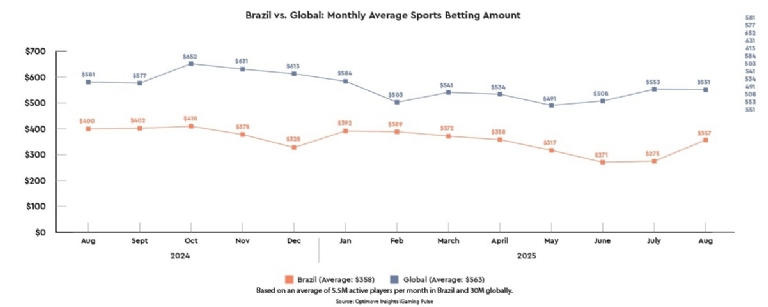

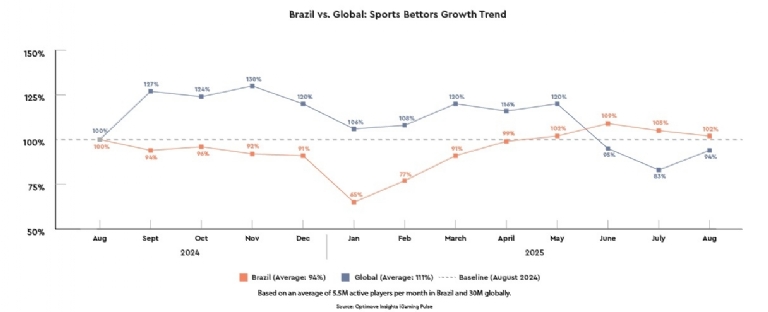

* Sports betting is volatile but recovering: Brazil continues to trail in average sports betting volume ($357 vs. $551 globally in August). However, it shows signs of continued recovery in bettor numbers, reaching 102% of the August 2024 baseline - up from 65% in January, though slightly down from 105% in July. The global market also showed improvement, rising from 83% in July to 94% in August.

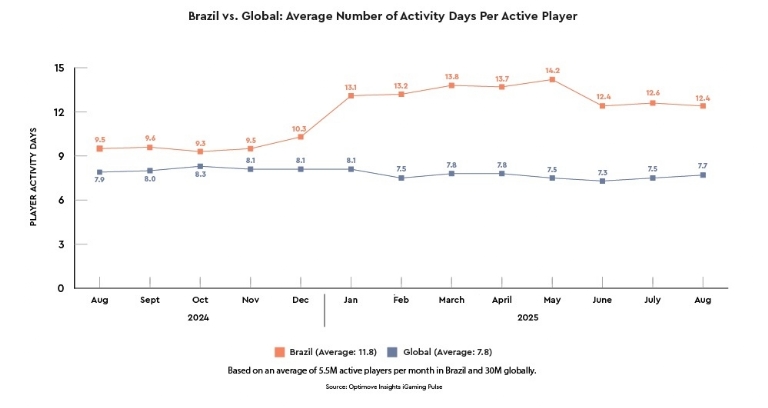

* Brazilian players are more engaged: Brazil continues to demonstrate significantly higher player engagement compared to global benchmarks. In August 2025, Brazilian users averaged 12.4 activity days per active customer, versus 7.7 days globally - a 1.6x gap. The average number of activity days in Brazil has remained stable since June, consistently hovering between 12.4 and 12.6 days.

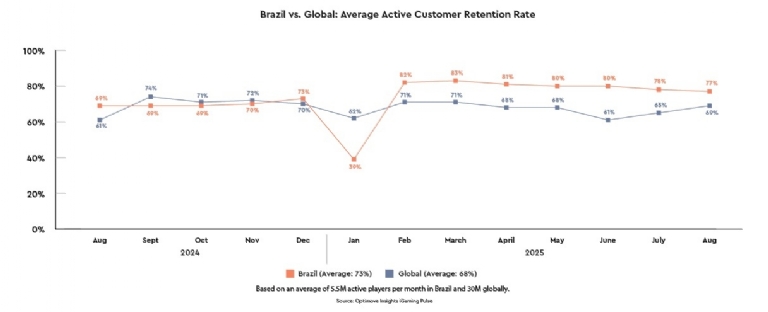

* Higher retention and consistent activity in 2025: Since February 2025, Brazil has consistently maintained a higher retention rate than the global average. In August 2025, Brazil’s retention reached 77%, compared to 69% globally, reflecting an 8-point advantage. Player activity has also remained steady in recent months, with Brazilian users averaging 12.4 activity days since June, versus a stable global average of around 7.7 days.

Conclusion:

While Brazil still trails global benchmarks in terms of average deposit and betting volumes, the market demonstrates notable strength in player engagement, retention, and recovery in user growth. Since early 2025, Brazilian players have shown consistently higher activity levels and loyalty compared to global averages.

These patterns suggest a highly engaged and resilient player base, pointing to long-term sustainability. As engagement remains strong and user growth rebounds, Brazil is well-positioned to evolve into a more balanced market.

Report Metrics:

- Source: Betting trends in Brazil compared to the global benchmark in the trailing 12 months (August 2024-2025).

- Database: A 12-month average of over 5.5 million active players per month in Brazil and over 30 million globally.

Category: Average Deposit Amount

Key findings: Brazil deposit amounts lag behind global average

Throughout the observed period, Brazil consistently trailed behind the global average in monthly average total deposit amounts. On average, global deposit levels were 2.1x higher than Brazil’s.

In August 2025, Brazil’s average monthly deposit amount reached $159, marking a 12% year-over-year increase from $142 in August 2024.

In contrast, the global deposit average stood at $327, reflecting a modest 2.5% increase from $319 a year earlier.

Definition of Average Deposit Amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of Sports and Casino bettors (players) who have made at least one deposit.

Category: Total Monthly Casino Betting Amount & Number of Casino Bettors Growth

Key findings: While global players still lead in spend, Brazil shows recent momentum in bettor growth

Throughout most of the year, global casino bettors consistently outspent those in Brazil. In August 2025, Brazil’s average monthly casino betting amount was $550, compared to a significantly higher $2,671 globally - marking a 4.9x gap. This ratio remained relatively stable throughout the year, with global players averaging $2,374 monthly versus $533 in Brazil.

However, when examining the growth in number of casino bettors, a different trend emerges. While Brazil’s early momentum peaked in October 2024 at 118% of its baseline, the most notable development is its consistent outperformance of global growth in the past three months.

From June to August 2025, Brazil’s casino bettor base grew faster than the global trend, reaching 111% of its August 2024 baseline in August 2025, compared to 106% globally.

This sustained growth in Brazil’s player base signals renewed momentum and interest, despite lower overall spending levels - highlighting a potentially expanding audience that could be further activated through targeted engagement and conversion strategies.

Definition of Total Monthly Casino Bet Amount: The average casino bet amount is the total sum of all casino bets and divided by the number of bettors who have placed at least one casino bet.

Definition of Casino Bettors Growth Trend: calculated by dividing the total number of casino bettors each month by the number of casino bettors in July 2024, which serves as the baseline (100%).

Category: Total Monthly Sports Betting Amount & Number of Sport Bettors Growth

Key findings: Brazil maintains growth advantage in bettor volume, though momentum softens

Throughout the year, global players consistently wagered more than Brazilian players. In August 2025, the average monthly sports betting amount globally was $551, compared to $357 in Brazil - a 54% gap, highlighting the continued disparity in spend per player.

However, Brazil has maintained a stronger growth trend in the number of sports bettors relative to the global market. While Brazil’s bettor volume reached 102% of its August 2024 baseline, this represents a slight drop from 105% in July, indicating a softening in growth momentum. In contrast, the global figure continued to decline, reaching 94%, a 6% year-over-year decrease.

Despite the recent slowdown, Brazil still outpaces the global trend in user growth, signaling ongoing expansion potential - even as per-player spend remains lower.

Definition of Total Monthly Sport Bet Amount: The average sport betting amount is the total sum of all sports bets and divided by the number of bettors who have placed in least one sport bet.

The Sport Bettors Growth Trend: calculated by dividing the total number of sport bettors each month by the number of sport bettors in July 2024, which serves as the baseline (100%).

Category: Average Number of Activity Days per Active Customer

Key findings: Brazil maintains strong engagement lead over global market

Brazil consistently demonstrated higher engagement levels compared to the global average in terms of average activity days per active customer. While the difference was modest during late 2024, the gap widened sharply starting in January 2025, reflecting a shift toward more sustained player interaction in Brazil.

In August 2025, Brazilian players logged an average of 12.4 activity days, compared to just 7.7 globally - a 1.6x higher engagement rate. This consistent advantage throughout 2025 highlights an increasingly loyal and active player base, likely influenced by improved user experience and a stabilizing regulatory environment. Meanwhile, global engagement remained largely flat, fluctuating only slightly between 7.5 and 8.3 days over the entire period.

Definition of Average Activity Days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

Category: Average Active Retention Rate

Key findings: Brazil maintains higher retention rates than global market since early 2025

While Brazil and the global market showed similar retention levels throughout most of 2024, a notable shift occurred beginning in February 2025, with Brazil consistently outperforming global benchmarks in user retention.

In August 2025, Brazil recorded a 77% retention rate, compared to 69% globally - a sustained 8 percentage point advantage. This trend has remained steady since February, with Brazil maintaining monthly retention rates between 77% and 83%, signaling a more loyal and resilient player base. In contrast, global retention fluctuated at lower levels, staying within the 61%–71% range.

Definition of Active Retention Rate: The percentage of bettors who were active in the preceding month and remained active in the current month.

Source: Optimove / GMB